Determine how to proceed in printing 1099-NEC Forms

...

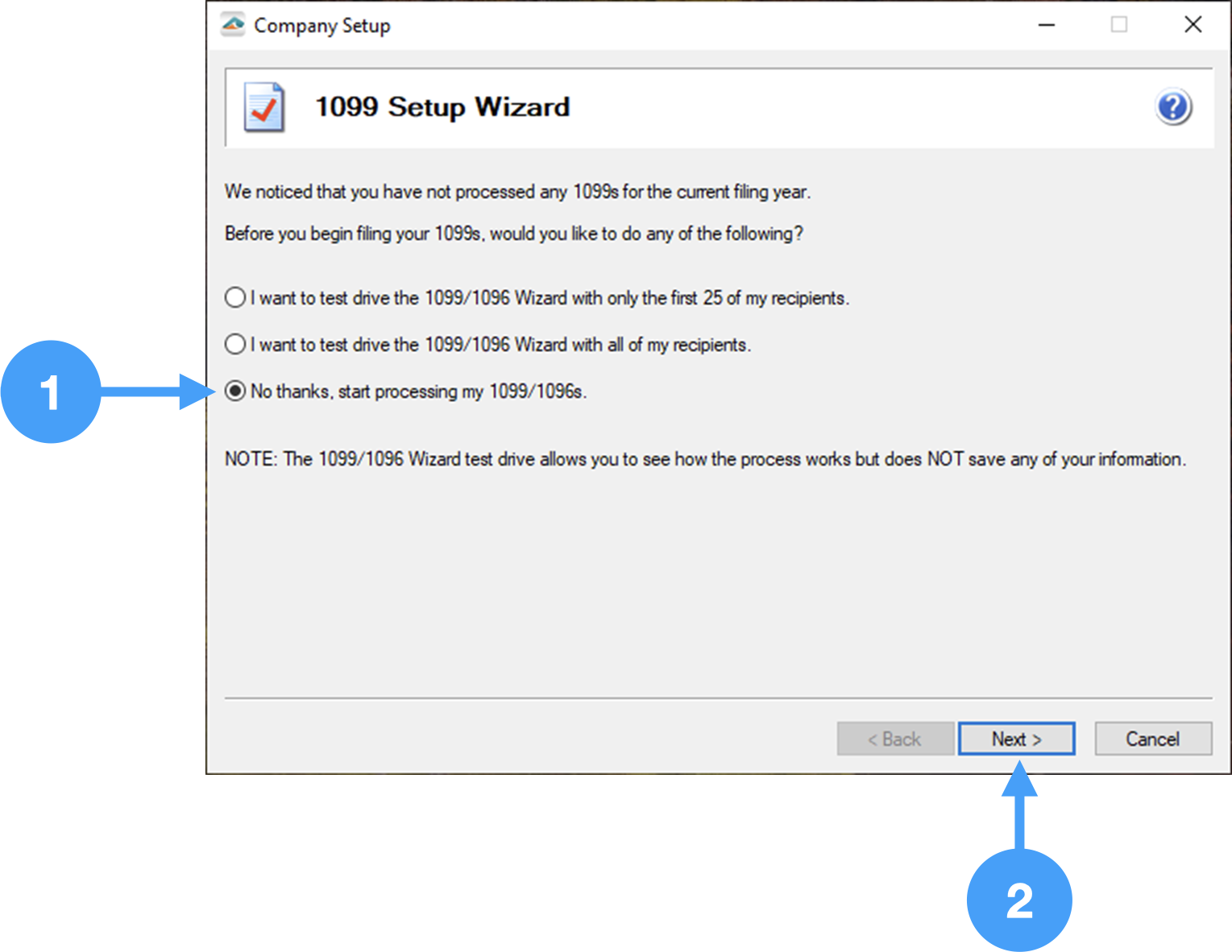

Do you want to run through a test of the 1099/1096 process?

If you wish to test the 1099 process, select either the first or second radio buttons. The testing process is identical to the actual processing, but no information is saved.

In our example, we

...

will select the third radio button

...

to begin the processing of the final copies.

- 1099 Setup Wizard window opens, select 'No thanks, start processing my 1099/1096s.'

- Click Next.

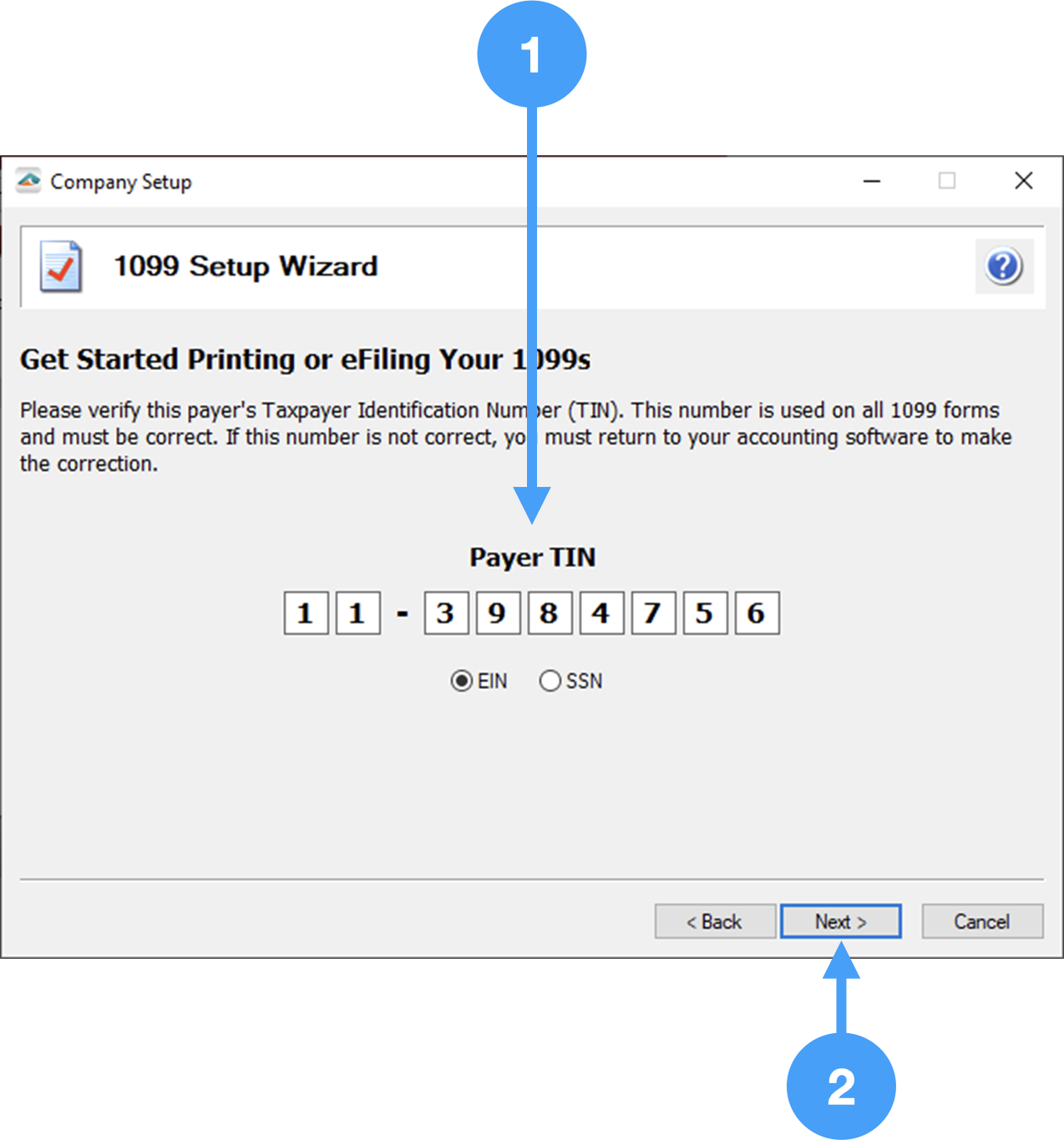

Review Payer Tax Identification Number (TIN)

- Ensure Payer TIN is correct.

- Click Next

Select the number of Data Files

- Typically, you would will select the choice for a single 1099 data file. You would use more than one data file should select 'Yes, I use multiple 1099 data files for this EIN.' if you have more than one CDMone CDM+ database for different entities of your organization.. Therefore, we will select 'No, I use a single 1099 data file for this EIN.'

- Click Next

Payer Information

- Ensure Payer Information is correct. Changes made in this window will not be reflected in CDM+.

- Click Next

...

- Select appropriate Tax Preparer choice. Typically, you would will select the first radio button. Ask a Tax Specialist if If you are unsure, ask a tax specialist what you should select.

- Click Next

State and Local Tax Items

...

- If you have any Vendors who have requested to receive electronic copies of their 1099's, you must select Yes. Otherwise, select No.

- Click Next

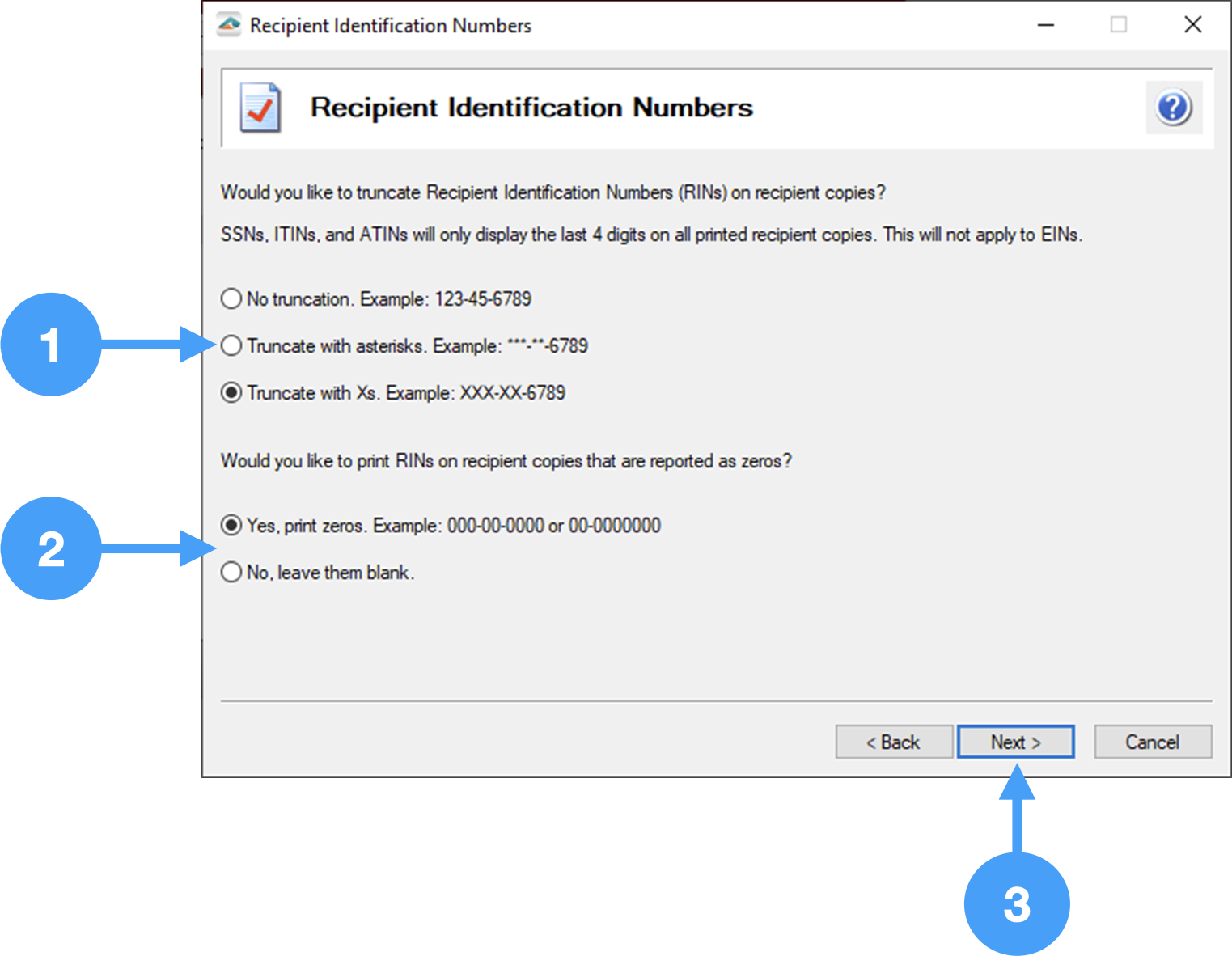

Recipient Identification Number

- Select how you want wish the Social Security, TIN and RIN numbers to be displayed. You can select to truncate Social Security or Individual Taxpayer Identification numbers using asterisks or 'X's'. We will select to truncate with asterisks.

- You have the option of printing Recipient Identification with zeros or leave them blank. We will print with zeros.

- Click Next

Video of the 1099 Wizard

| Widget Connector | ||||||

|---|---|---|---|---|---|---|

|