...

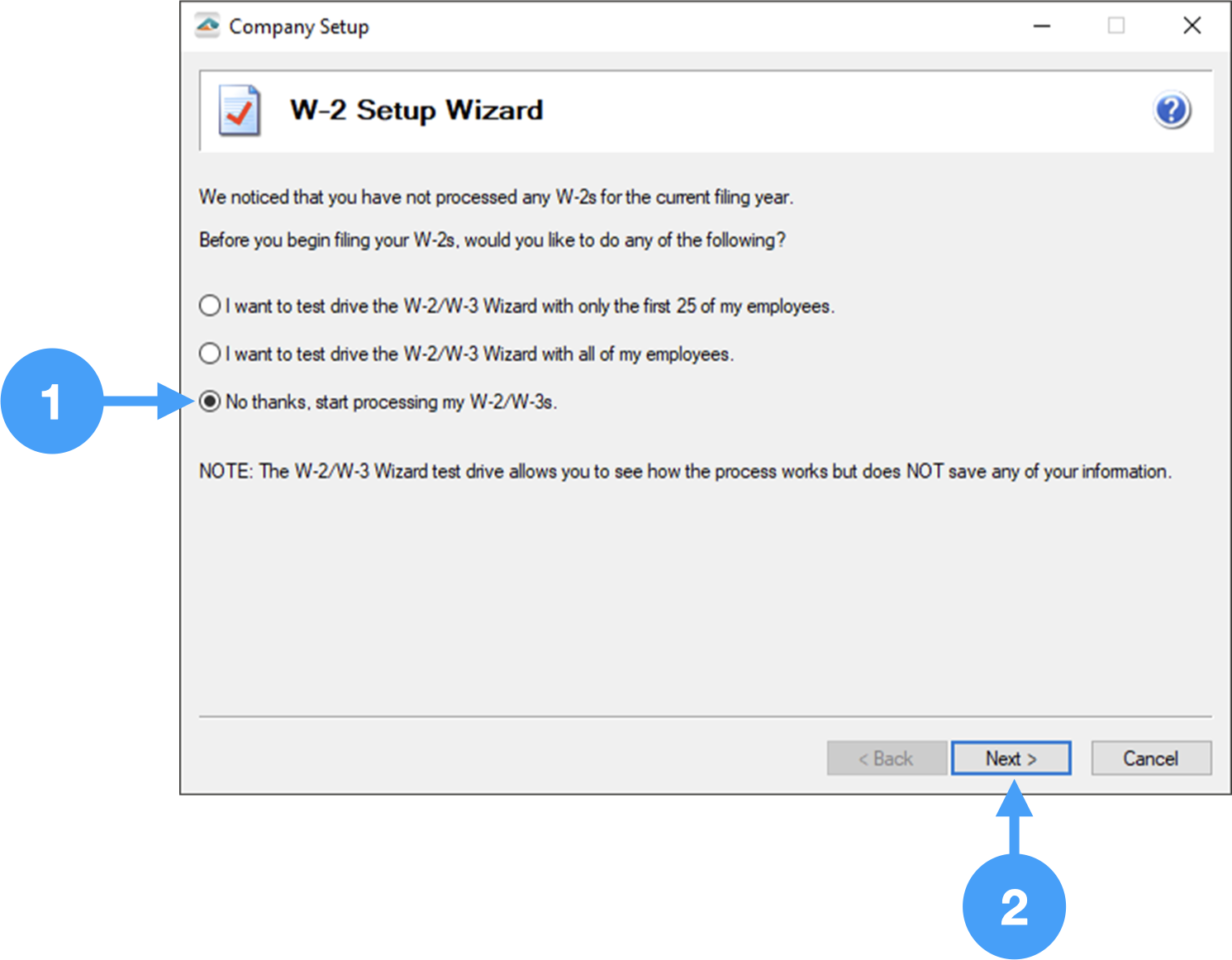

- The first window gives you the option to test following options:

- Test drive the W-2/W-3

- Wizard with only the first 25 employees

- Test drive with all of your employees

- , or

- Start processing your W-2/W-

- 3's. This is the option we'll select.

- Click Next to move to the next window.

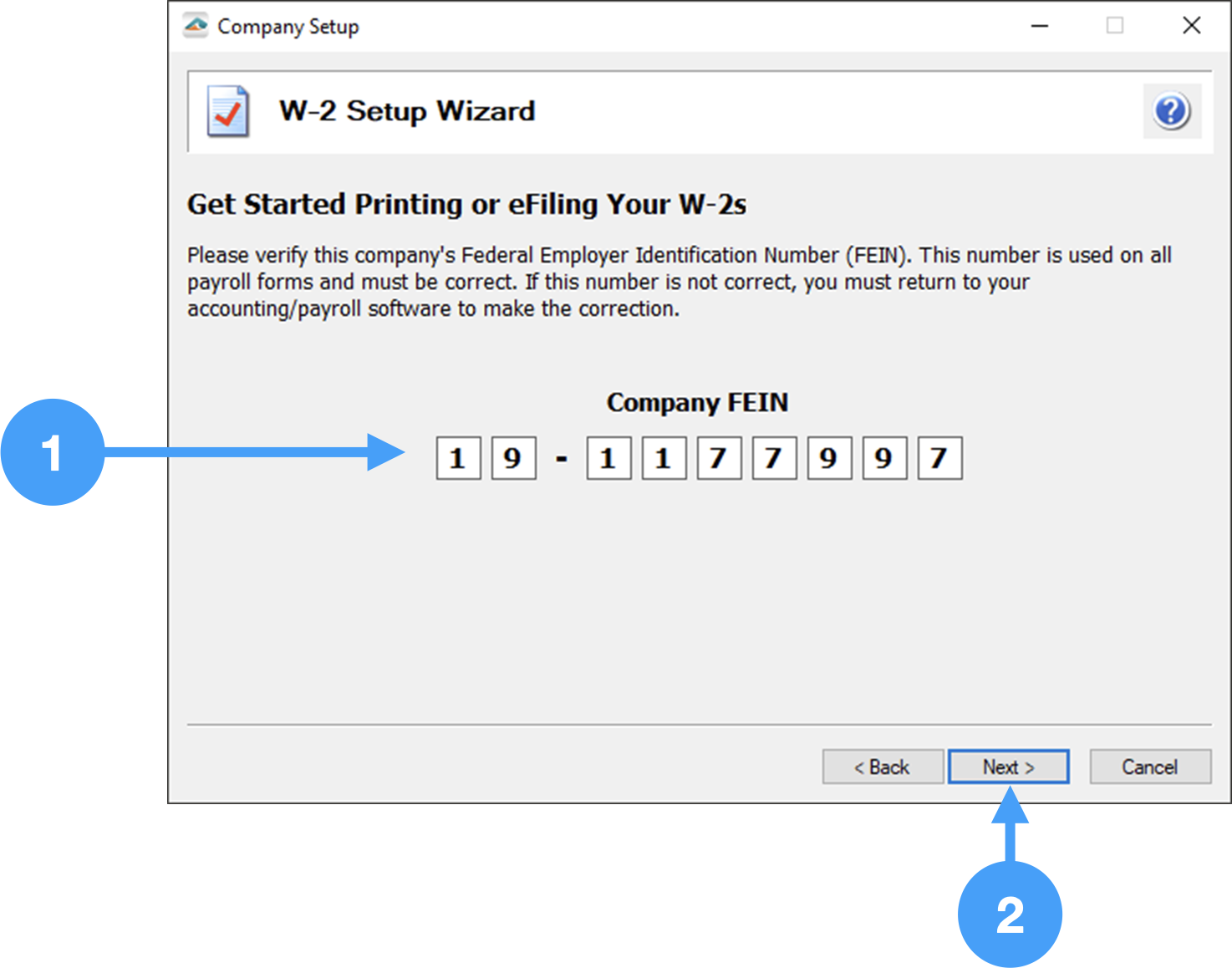

Company Federal Employer Identification Number (FEIN)

- Verify the Company FEIN is correct. If it isn't, you can correct it here.

- Click Next to move to the next window.

| Note |

|---|

Any changes made in the Setup Wizard will not be reflected in CDM+. |

Multiple or Single Data Files

- There are situations where an organization may have two or more databases for the same FEIN number. In those cases, you need to select 'Yes, I use multiple payroll data files from the EIN.' However, in our case, we use 're using only one database so we will 'll select 'No, I use a single payroll data file for the EIN.'

- Click Next to move to the next window.

...

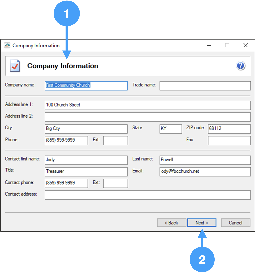

- Review all of the information on this screen. This information is included on the W-2/W-3s so it must be accurate and complete.

- When you are satisfied that the information is correct, click Next to move to the next window.

| Note |

|---|

You can make changes in this window, but these changes will not be reflected in CDM+. To update your payroll information in CDM+, you need to go to Payer Records |

...

. |

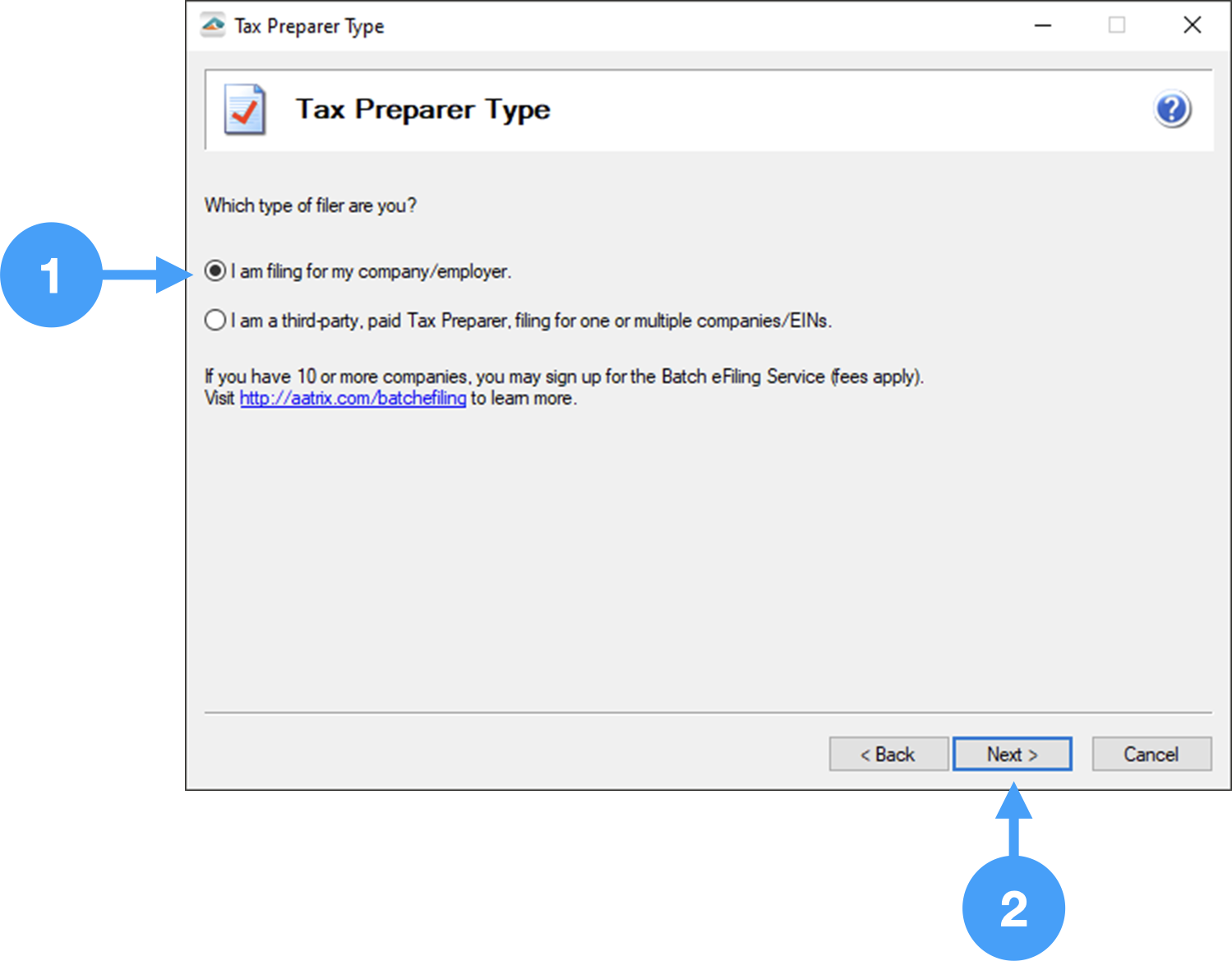

Identify Tax Payer Type

- If Since you are filing the W-2's for your church or organization, select the first radio button.

- Click Next to continue to the next window.

Data Verification Setup

| Warning |

|---|

It is important that |

...

the responses to questions 1 and 2 are 'Yes'. Failure to select Yes for questions 1 and 2, will force you to quit the verification process and go back through the Setup Wizard. This is because the verifier of the Aatrix Forms Viewer will perceive an error since no FICA/Medicare taxes were withheld. |

- The first item MUST be set to 'Yes'. Marking this item as 'No' will keep you from completing the Data Verification process.

- The second item MUST also be set to 'Yes' to ensure that you can complete the Data Verification process.

- Click Next to continue to the next window.

...

- Select 'No' for this item if . If you do not have any employees any employees who are tribal council members, then select 'Yes'.

- Click Next to continue to the next window.

...

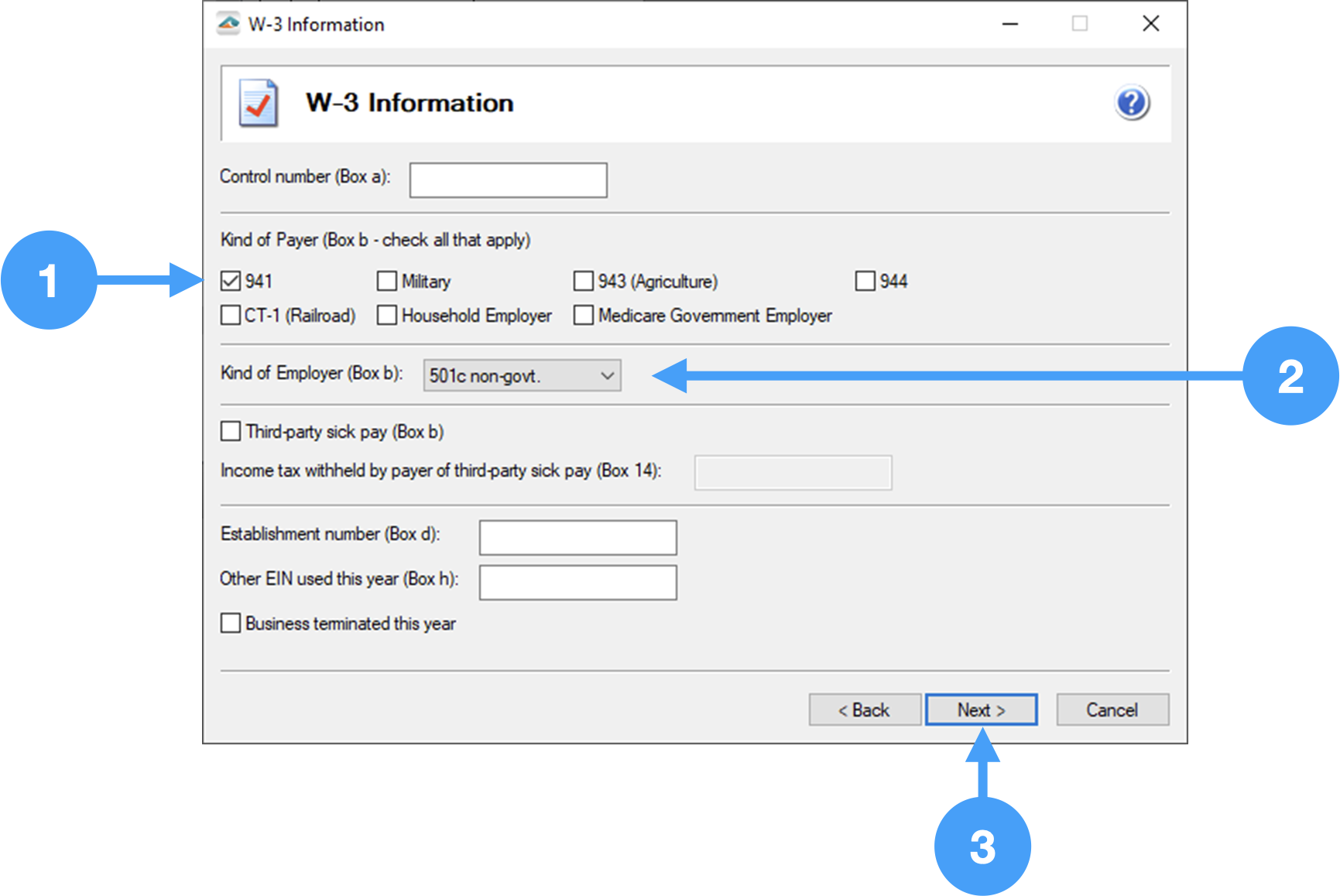

- Under the Kind of Payer section of the window, select the '941' checkbox.

- Under the Kiind Kind of Employer section, select '501c non-govt.'

- Click Next to continue to the next window.

...

Employee Social Security Numbers

...

- In the first sectionthis window, you can set how the employee's Social Security Numbers will print on the W-2 forms. There is the option of truncating the numbers or printing them as entered. In our example, we are going truncate using 'X's.

- In the second section, the Recipient Identification Number can be printed as zeroes or it can be left blank. It is your choice. Our example prints them as zeroes.

...

- When you truncate the Social Security Numbers, you hide all but the last four digits with asterisks or X's.

- Click Next to move to the next step of the W-2 process.

Video of the Process

...