Before we begin processing W-2's, we need to ensure that specific areas in CDM+ Payroll are properly set up. These areas include:

- Payroll Payer Records

- Deduction Setup

- Employee Records Setup and Housing Allowance Pay Item

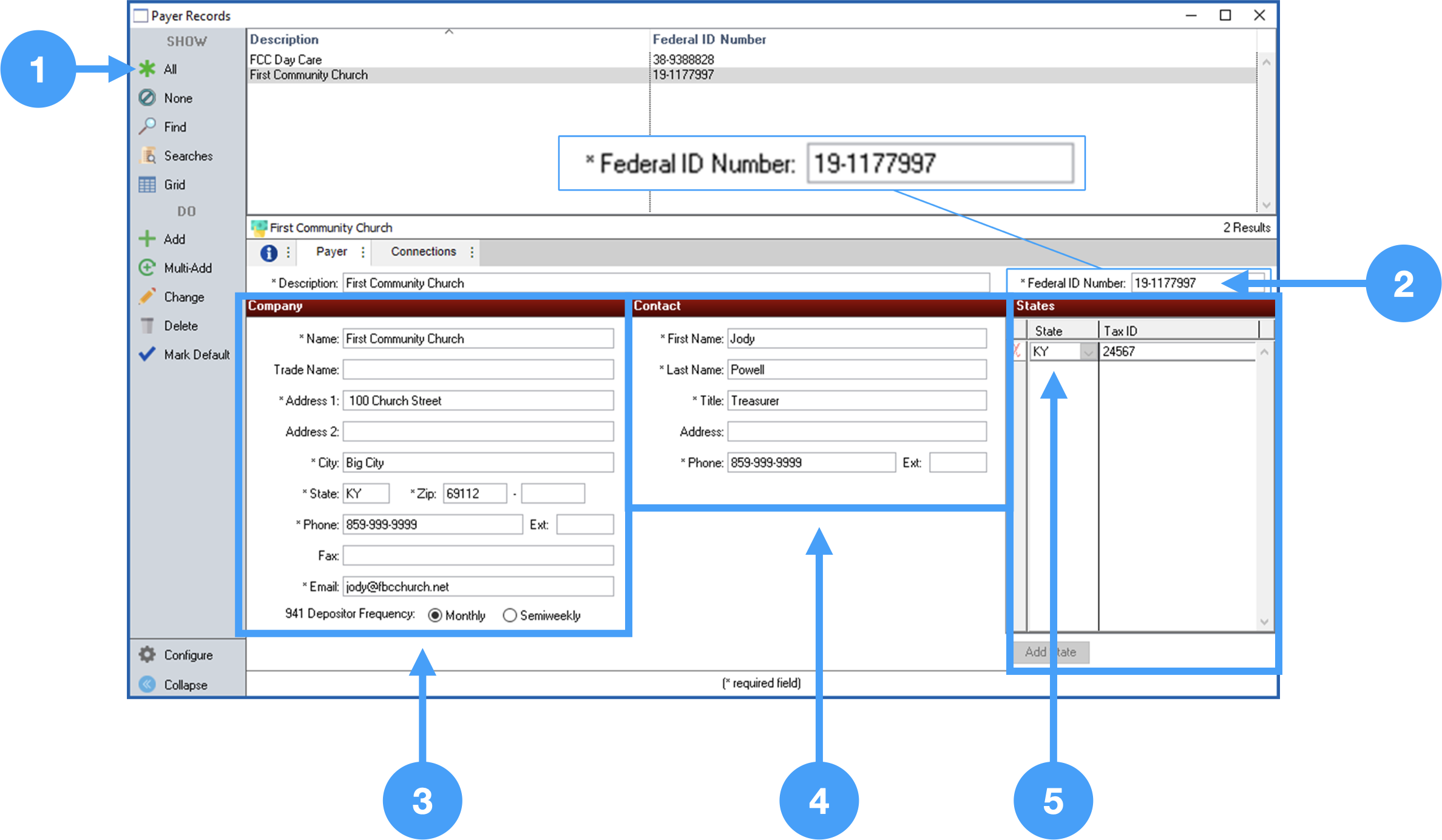

Review Payer Records

Program > Payroll > Payer Records

- Click All in the lefthand sidebar to see all of the created payer records. Select the one used to create your 2020 payroll.

- Ensure the Federal ID Number is correct.

Review Company information and make sure it is correct.

- Review Contact information and ensure that it is correct. This can also be updated in Aatrix Forms Viewer, but it will not be updated in CDM+.

This information can be updated in the Aatrix Forms Viewer, however, this does not update the information in CDM+.

Also, ensure that the proper 941 Depository Frequency is selected. If you file a Schedule B form, then select 'Semiweekly'. In our example, the church does not file a Schedule B so 'Monthly' is selected.

- Ensure a State is selected and the State's Tax ID is correct.

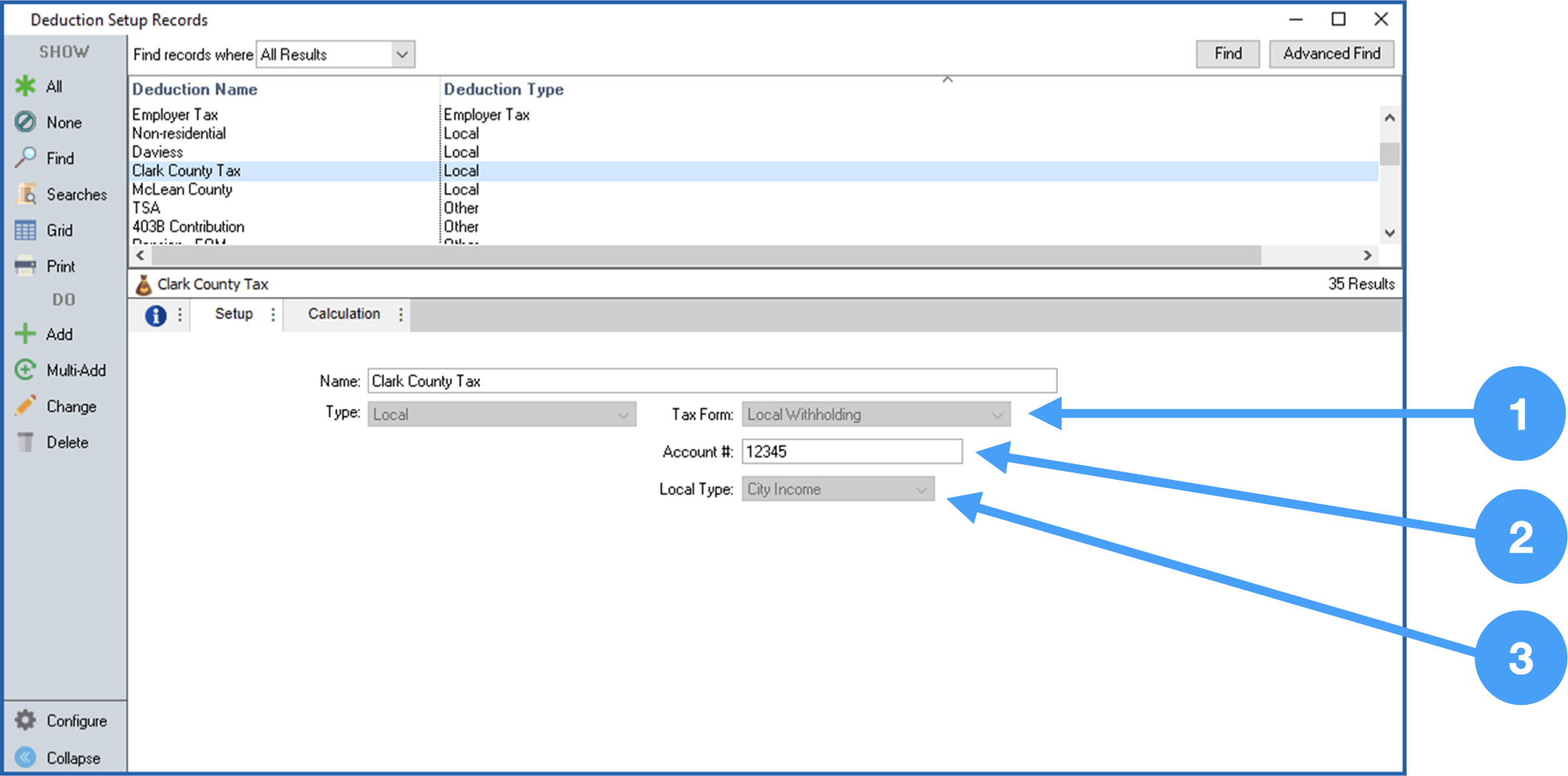

Review Deductions

Example: 403-B Deductions to be printed on W-2's

Program > Payroll > Deduction Setup Records

Select the 403-B deduction in the Results list.

- Select All

- Select the '403-B Deduction' in the Results List.

Ensure the W-2 Field is correct for any deductions that will show on W-2s.

You can perform a simple search to find a specific deduction, by clicking on the Find option in the lefthand sidebar.

Example: Local Tax Setups

Select the Local Tax deduction in the Results list.

- Ensure the Tax Form field is set to 'Local Withholding'.

- Ensure the correct local tax account number is correct.

- Ensure the correct Local Type is selected.

Review all deductions that will be reported on your W-2's to ensure that the W-2 field has the appropriate option selected. Contact a Tax Professional if you are unsure of the appropriate selection.

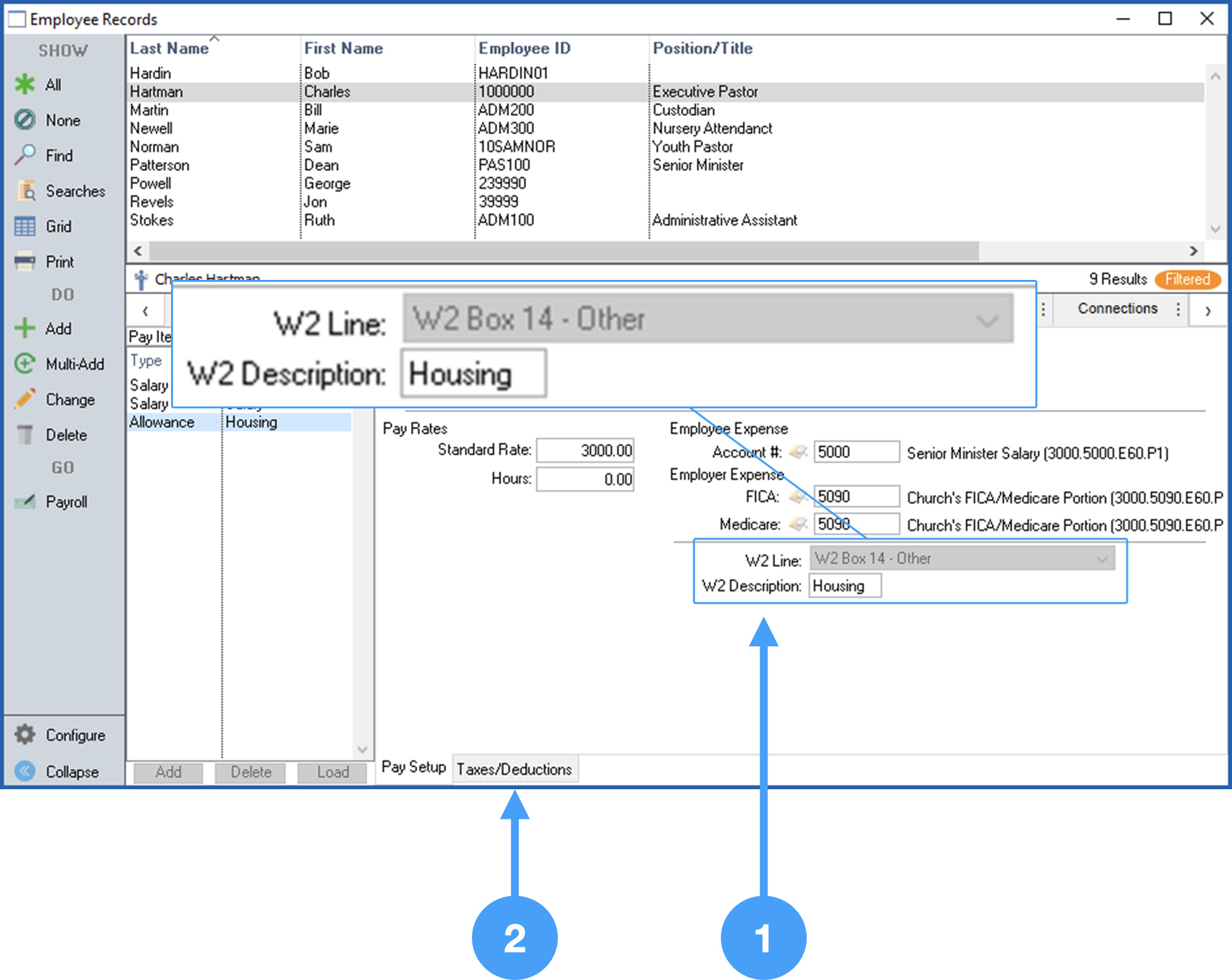

Review Employee Record Setup

Program > Payroll > Employee Records

- Select an employee to review.

- Select the Setup tab.

Review the information under the W-2 section of the Employee Records Setup tab. For example, if an employee is contributing to a retirement plan, then the checkbox labeled 'Retirement Plan' must be checked. Also, if there are employees who have elected to receive electronic W-2's, then the checkbox labeled 'Electronic W2 Only' must be checked.

The Electronic W2 Only option requires that you have signed authorization forms for each employee electing to receive electronic W-2's only. NOTE: NO paper W-2's are generated when this is selected.

- Now, let's look at the Housing Allowance Pay Item. Click on the Pay Items tab.

Review Employee Record Housing Allowance Pay Item W-2 Field Setup

- Ensure that the W-2 Line for the Housing Allowance is set to 'W2 Box 14 - Other' and the W2 Description reads 'Housing'.

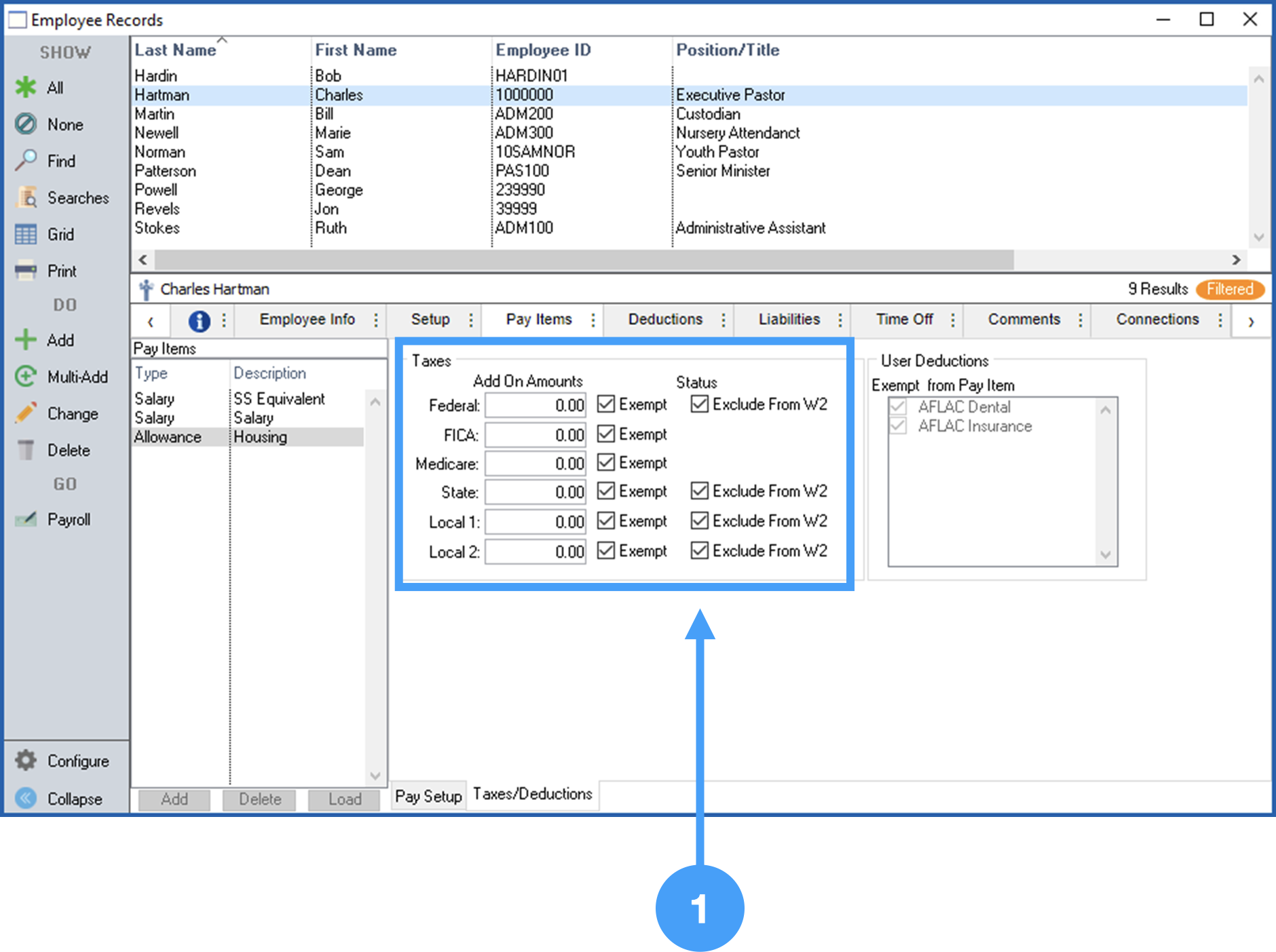

- Click on the Taxes/Deduction tab.

Review Employee Record Housing Allowance Pay Item Setup

Ensure all Tax Items are set to 'Exempt' and all of the checkboxes for 'Exclude from W-2' under Status are checked.

Ensuring that the checkboxes under Status are checked is critical. If these checkboxes are not checked, then the Housing Allowance will be included in Box 1 of the W-2 and not Box 14.

Begin the W-2 Process

With the above items reviewed, we are ready to begin the processing of this year's W-2's.

Reports > Payroll Reports > Payroll Tax Forms

- Select 2020 W-2/W-3.

- Enter '2020' in the Year field.