Reviewing Vendor Records

Program → Payables → Vendor Record

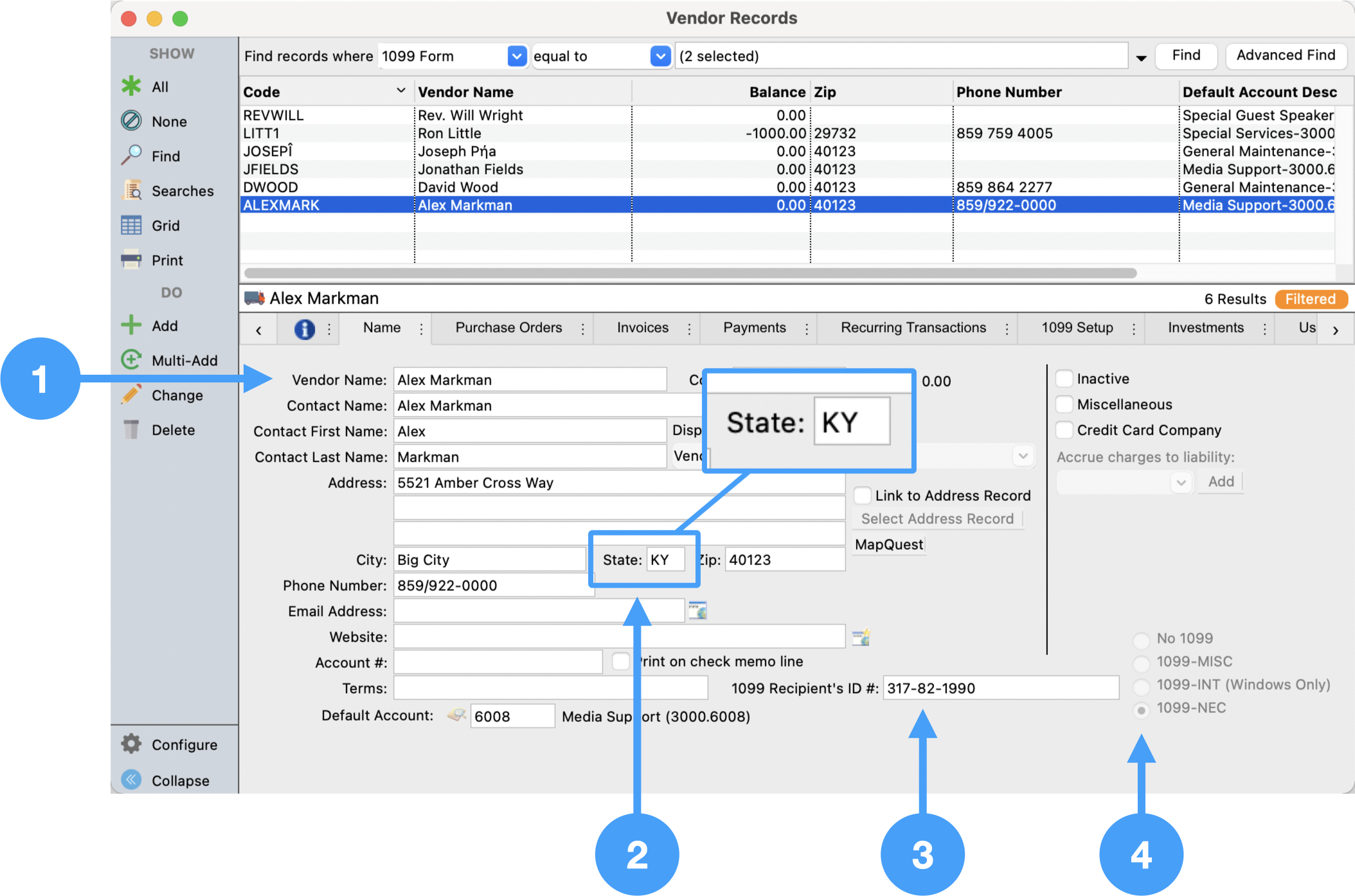

- Ensure Name and Address are correct.

- Ensure the state is exactly two characters.

- Ensure 1099-NEC is selected.

- Ensure 1099 Recipient's ID number is correct.

Prepping Your 1099

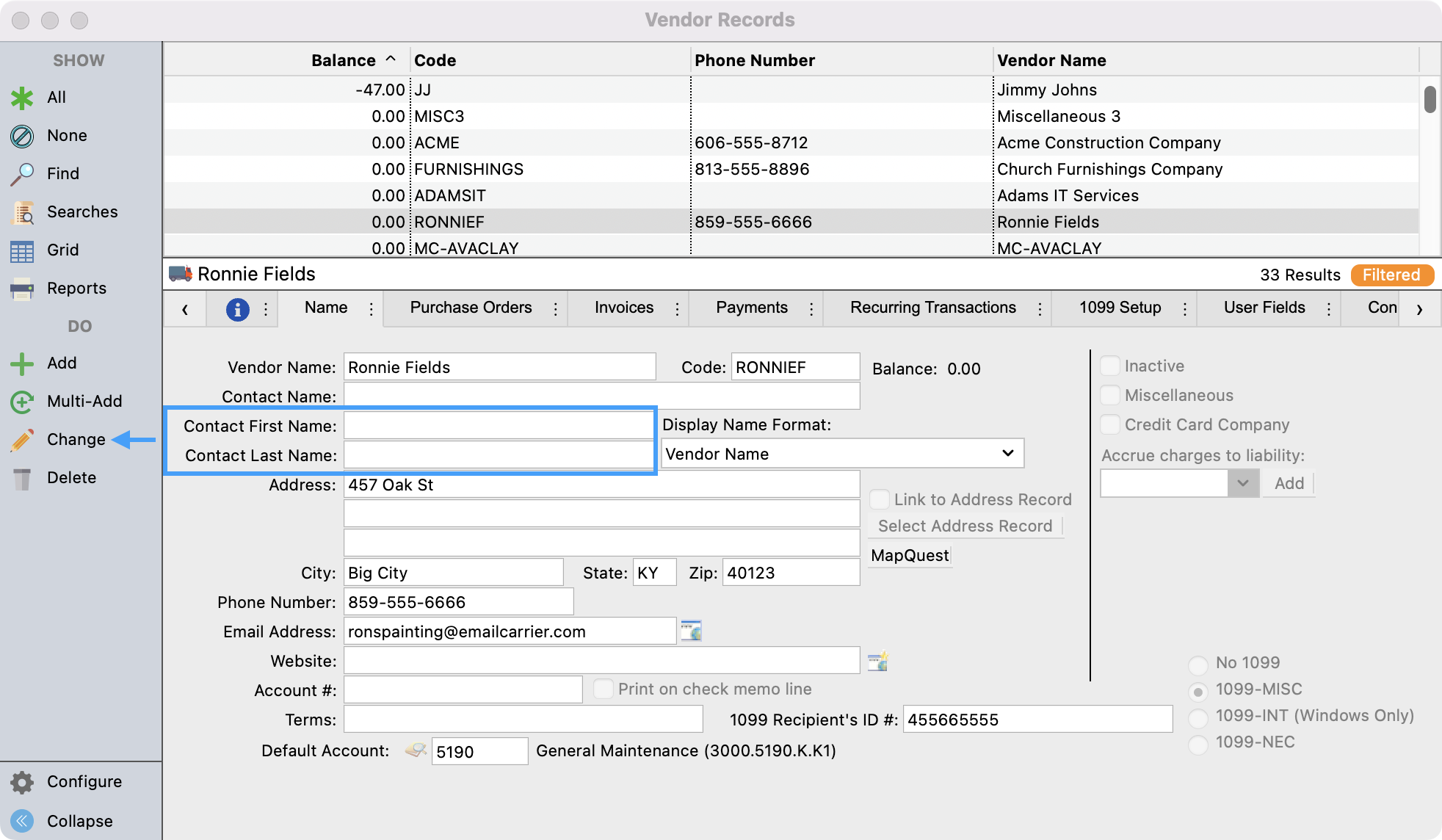

It is an IRS requirement that Vendors using a SSN must have the first and last name fields completed on the form. If you notice that the Contact First Name and Contact Last Name fields are blank, click on Change, from the left sidebar.

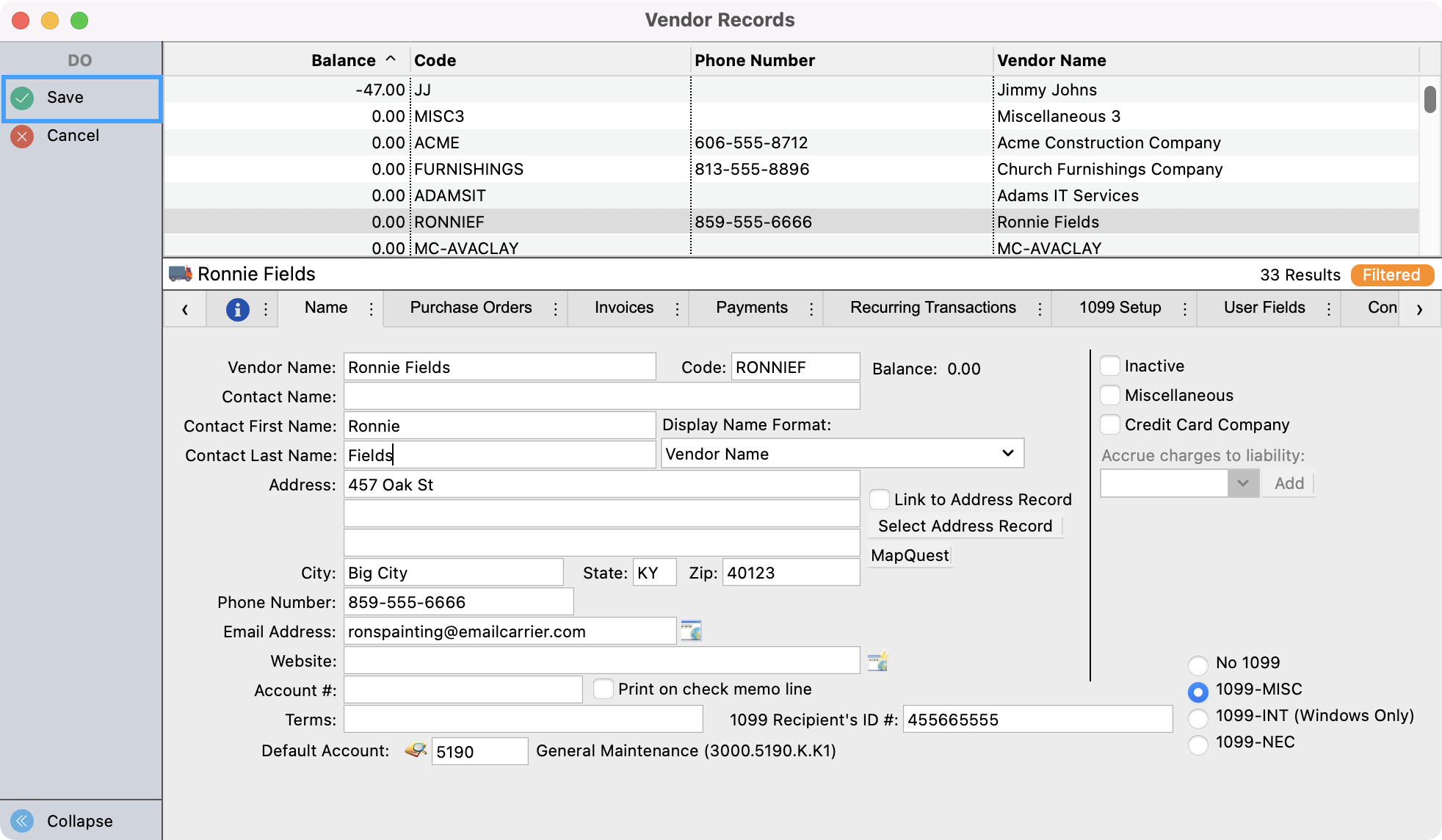

Fill in these required fields and then Save your changes.

Once this information is filled it you can run your 1099’s like normal.

Vendor Records - Payments Tab

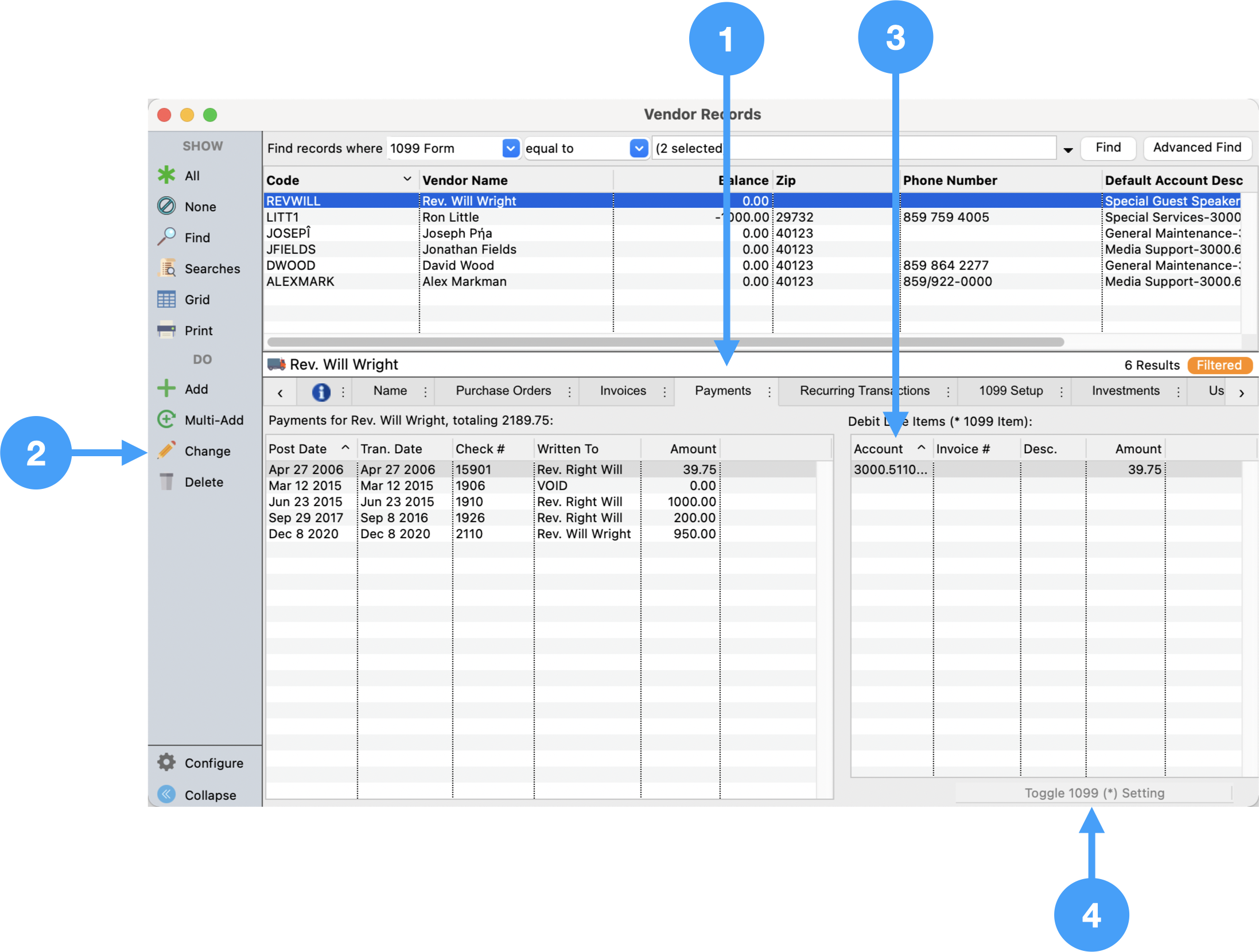

Ensure Expense accounts are tagged as 1099 showing an asterisk beside the account number. This is visible in the table on the right side of the Payments tab.

- Select Payments tab

- Click Change in Sidebar

- Select the expense line you want to toggle.

- Click Toggle 1099 ( * ) Setting

- Click Save

Below is an animation of the process in action:

If a payment to the vendor does not appear on the Payments tab, find the payment under Program → Ledger → Ledger Entry Records and ensure the vendor is selected in the Vendor field.

Vendor Records - 1099 Setup Tab

There is no setup required under the 1099 Setup tab for 1099-NEC forms.

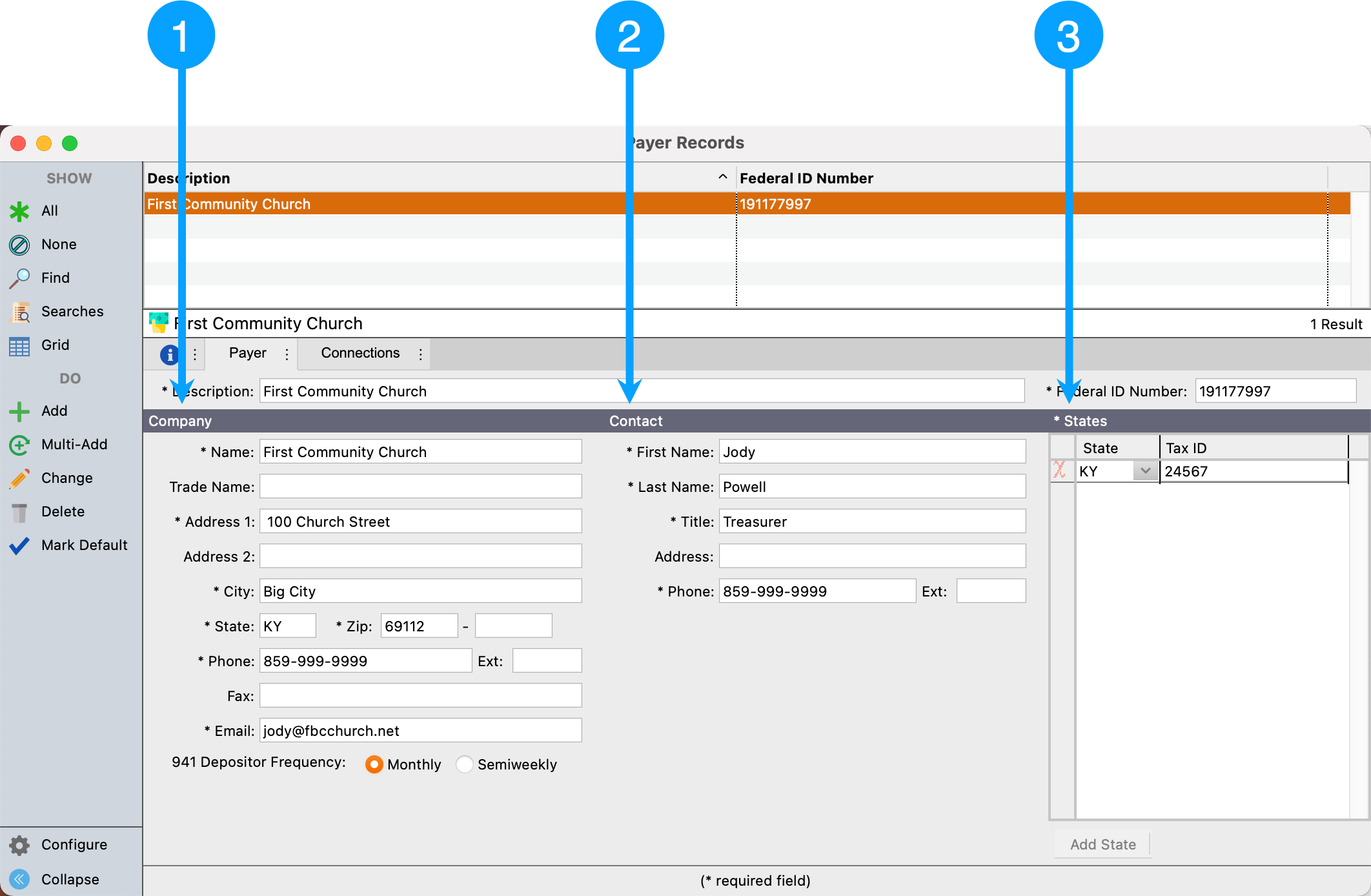

Payer Records

Program → Accounting → Payer Records

- Ensure the Company information is correct.

- Ensure the Contact information is correct.

- Ensure State is selected.

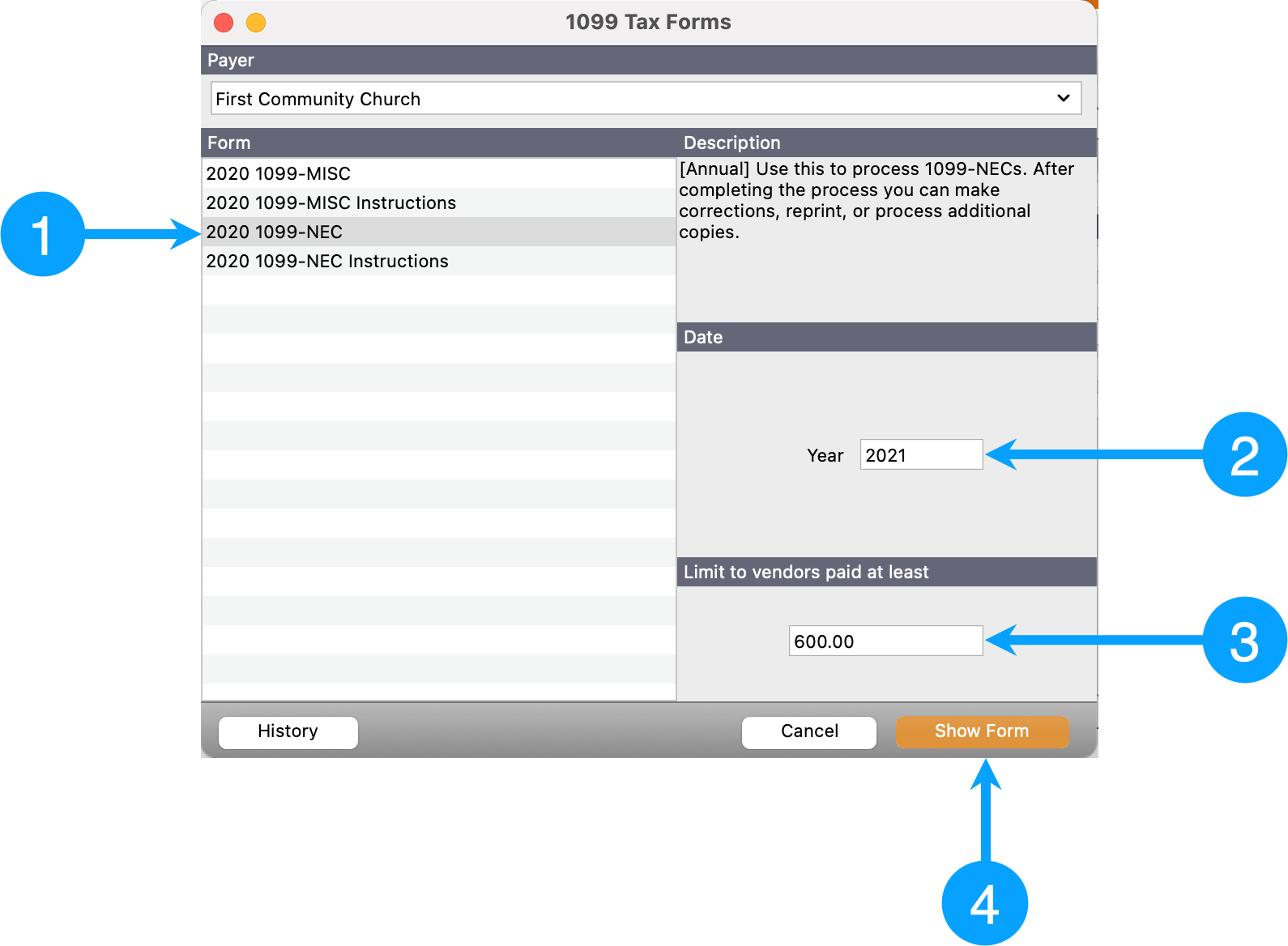

Processing 1099-NEC Forms

Reports → Payables → 1099 Forms

- Select 1099-NEC

- Enter 2020 for the Year field.

- Ensure Vendor Limit is set to '600.00'

- Click Show Form