Before we begin processing W-2's, we need to ensure that specific areas in CDM+ Payroll is are properly setupset up. These areas include:

- Payroll Payer Records

- Deduction Setup

- Employee Records Setup and Housing Allowance Pay Item

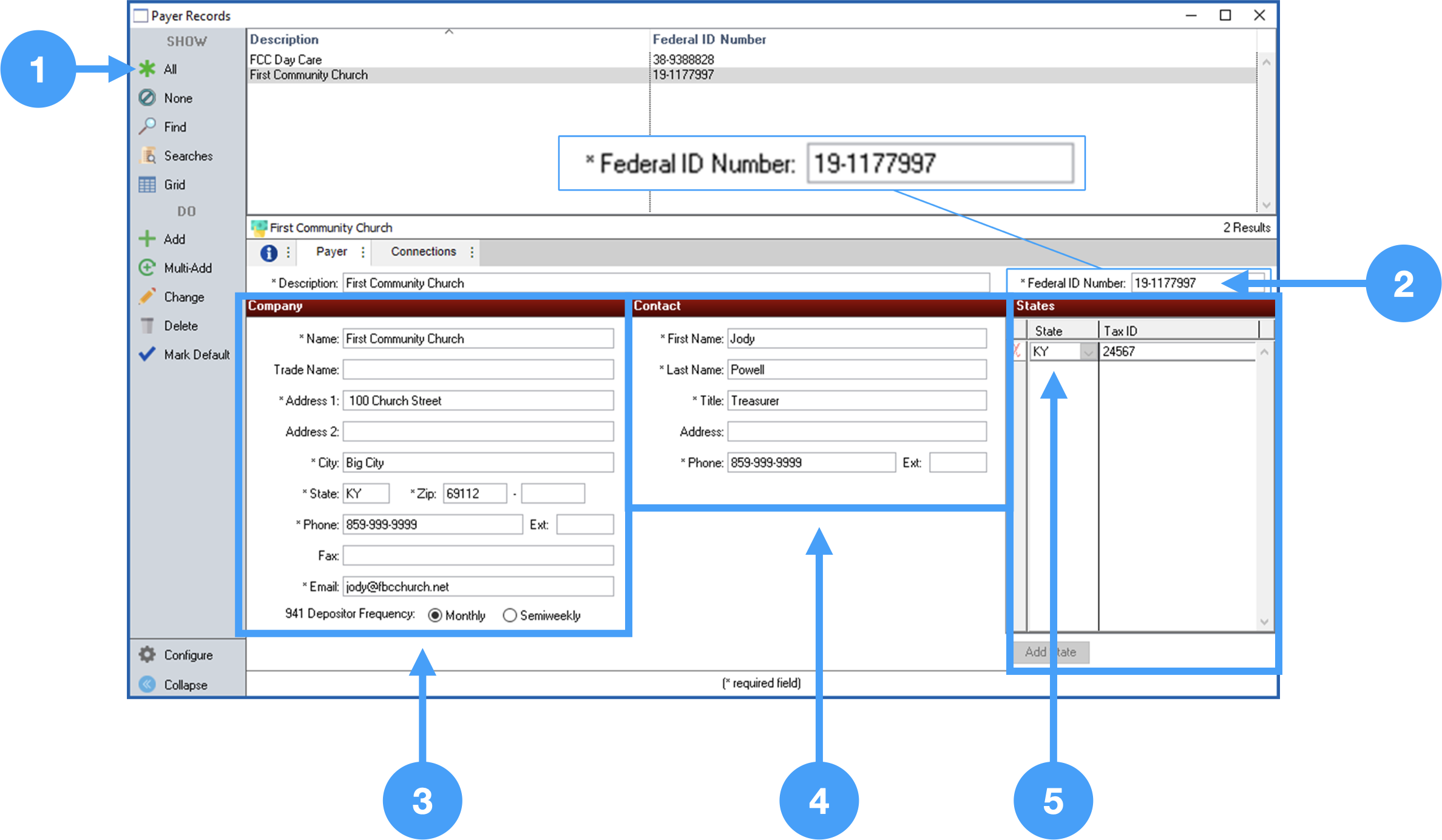

Review Payer Records

...

Program > Payroll > Payer → Payroll → Payer Records

- Click All in the lefthand sidebar to see all of the created payer records that have been created. Select the one you will be filing W-2sused to create this past year's payroll.

- Ensure the Federal ID Number is correct.

Review Company information and make sure it is correct.

This information can- Review Contact information and ensure that it is correct. This can also be updated in the Aatrix Forms Viewer, but it will not be updated in CDM+.

Warning This information can be updated in the Aatrix Forms Viewer, however, this does not update the information in CDM+.

forms are neededNote Also, ensure that the proper 941 Depository Frequency is selected. If you file a Schedule B

thisform, then select 'Semiweekly'. In

Monthly will be used.Review Contact information and ensure that it is correct. This can also be updated in Aatrix Forms Viewer, but it will not be updated in CDM+our example,

the church does not file a Schedule B so 'Monthly' is selected.

- Ensure a State is selected and the correct State's Tax ID is entered for the statecorrect.

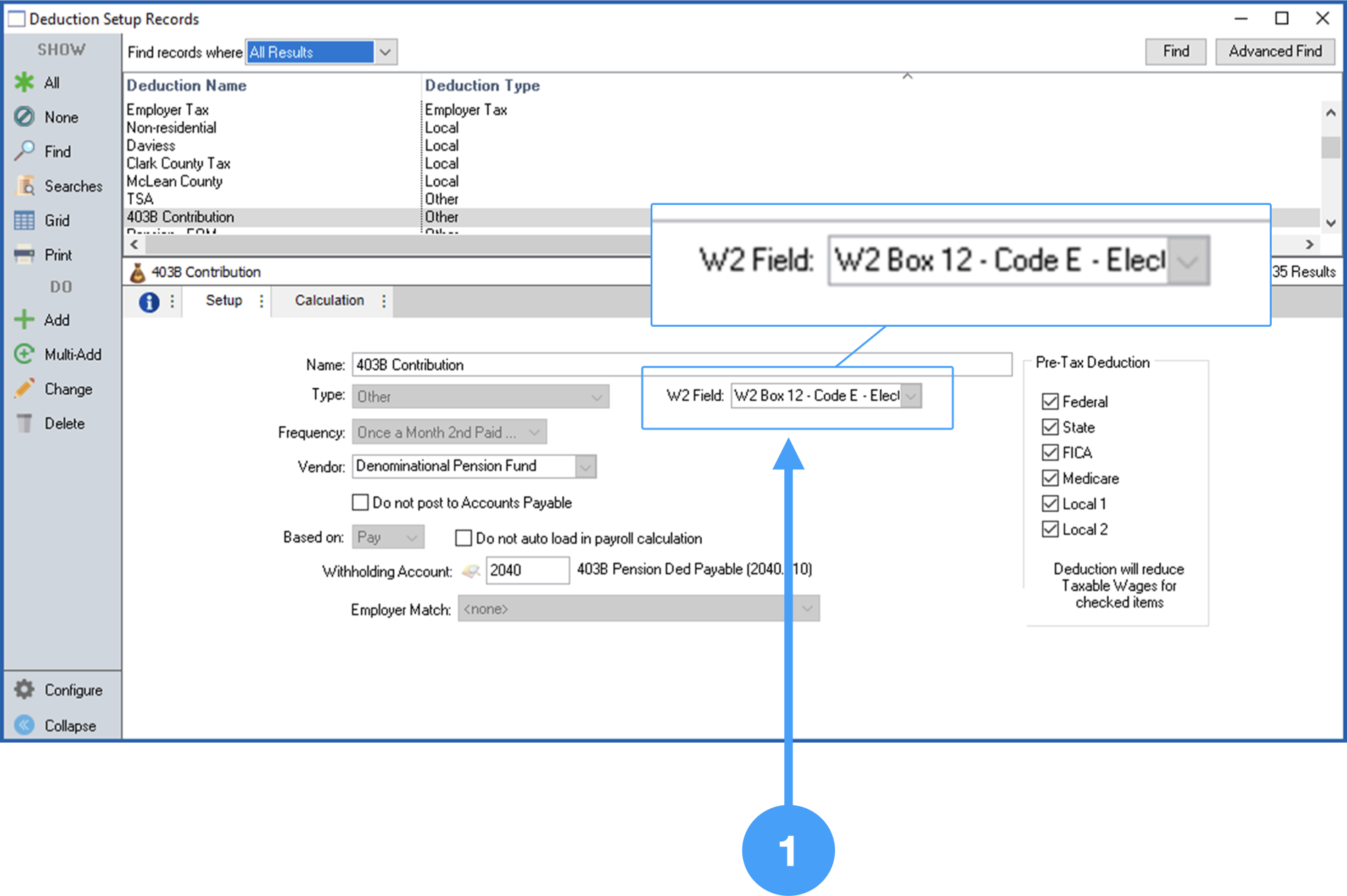

Review Deductions

Example: 403-B Deductions to be printed on W-2's

Doc path

Select the 403-B deduction in the Results list.

- Select All

- Select the '403-B Deduction' in the Results List.

Ensure the W-2 Field is correct for any deductions that will show on W-2s.

You will also want to review other W-2 related deductions and ensure that the proper W-2 field is selected. You can contact your Tax Professional for this information.

...

Tip You can perform a simple search to find a specific deduction, by clicking on the Find option in the lefthand sidebar.

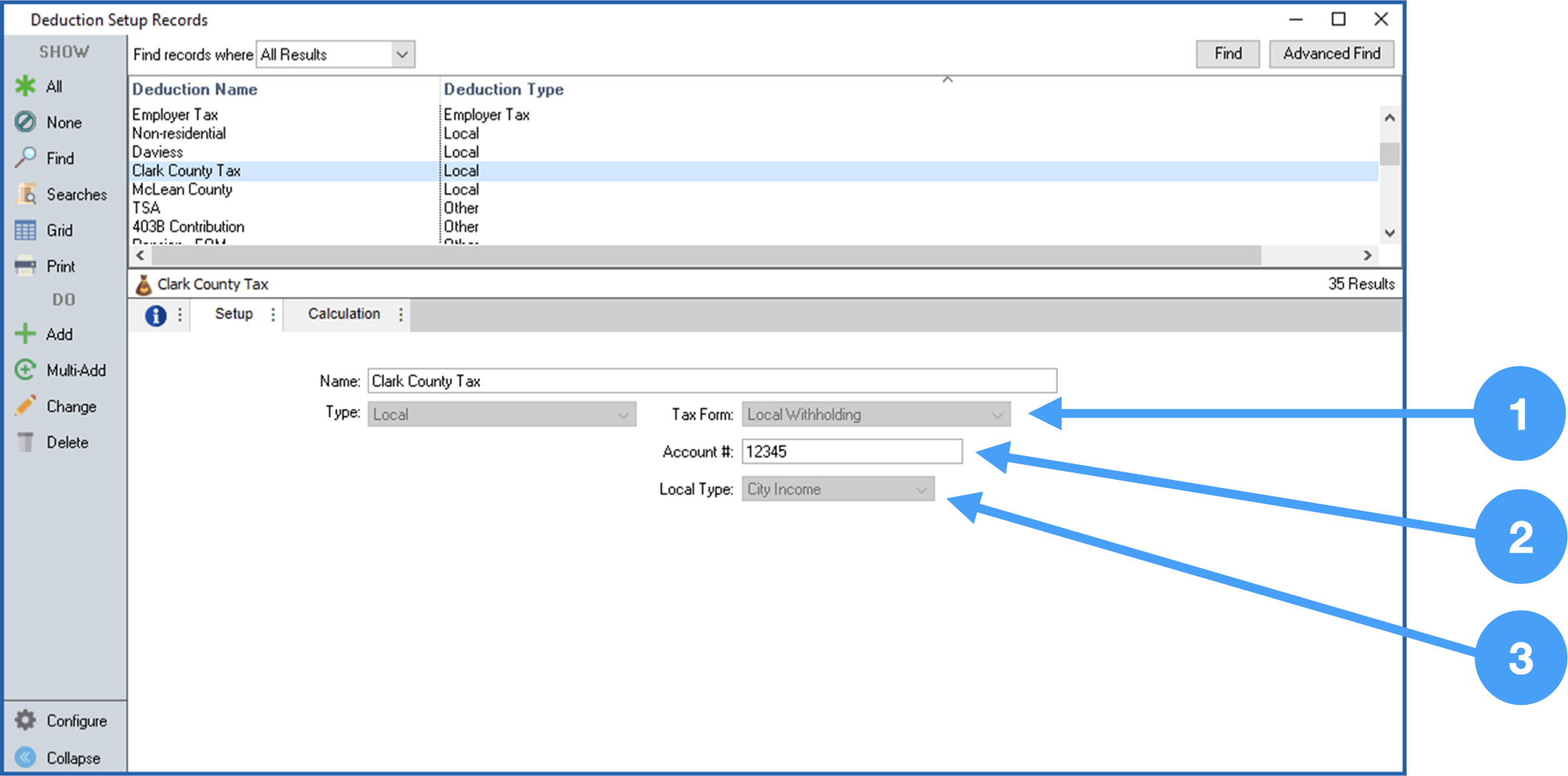

Example: Local Tax Setups

Select the Local Tax deduction in the Results list.

- Ensure the Tax Form field is set to 'Local Withholding'.

- Ensure the correct local tax account number is enteredcorrect.

- Ensure the correct Local Type is selected.

| Note |

|---|

Review all deductions that will be reported on your W-2's to ensure that the W-2 field has the appropriate option selected. Contact a Tax Professional if you are unsure of the appropriate selection. |

Review Employee Record Setup

...

Program > → Payroll > → Employee Records

- Select an employee to review.

- Select the Setup tab.

Review the information under the W-2 section of the Employee Records Setup tab. For example, if an employee is contributing to a retirement plan, then the checkbox labeled 'Retirement Plan' must be checked.

In additionAlso, if there are employees who have elected to receive

theirelectronic W-2's

electronically, then the checkbox labeled 'Electronic W2 Only'

shouldmust be checked.

This also

authorizations fromNote The Electronic W2 Only option requires that you have signed

. There will beauthorization forms for each employee electing to receive electronic W-2's

generated for these employeesonly. NOTE: NO paper W-2's

are generated when this is selected.

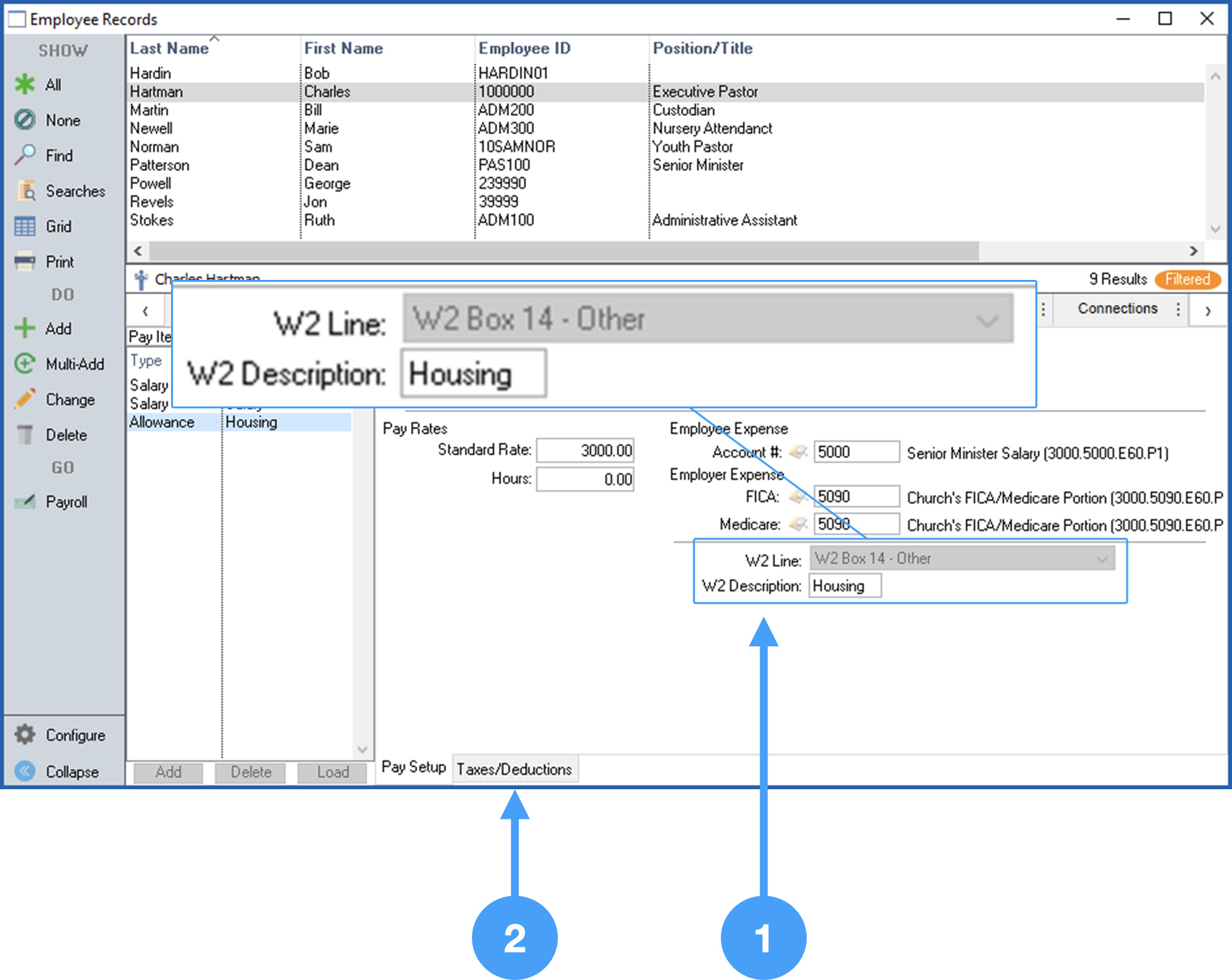

- Now, let's look at the Housing Allowance Pay Item. Click on the Pay Items tab.

...

Review Employee Record Housing Allowance Pay Item W-2 Field Setup

- Ensure that the W-2 Line for the Housing Allowance is set to 'W2 Box 14 - Other' and the W2 Description reads 'Housing'.

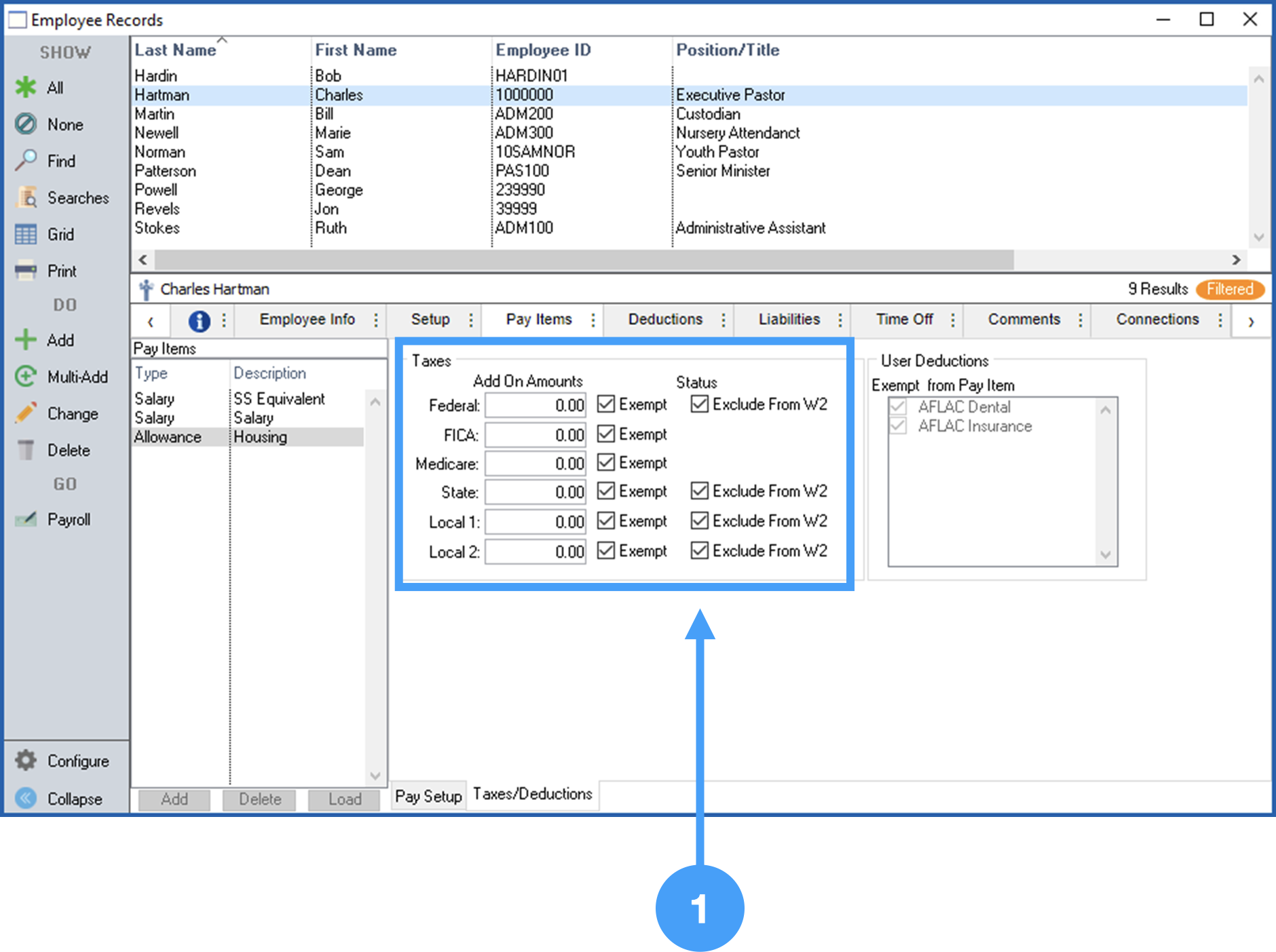

- Click on the Taxes/Deduction tab.

Review Employee Record Housing Allowance Pay Item Setup

- Review of the information under Status is important to ensure the employee's Housing Allowance is properly setup. Housing Allowance should have all Tax items

Ensure all Tax Items are set to 'Exempt' and all of the checkboxes for 'Exclude from W-2'

should be checked for all items. The 'Exclude from W-2' is especially criticalunder Status are checked.

Note Ensuring that the checkboxes under Status are checked is critical. If these checkboxes are not checked, then the Housing Allowance will be included in Box 1 of the W-2 and Box 14 which will overstate your income in Box 1.

Begin the W-2 Process

With the above items reviewed, we are ready to begin the processing of this year's W-2's.doc-path

- Select 2020 the past year's W-2/W-3.

- Enter '2020the past year' in the Year field.