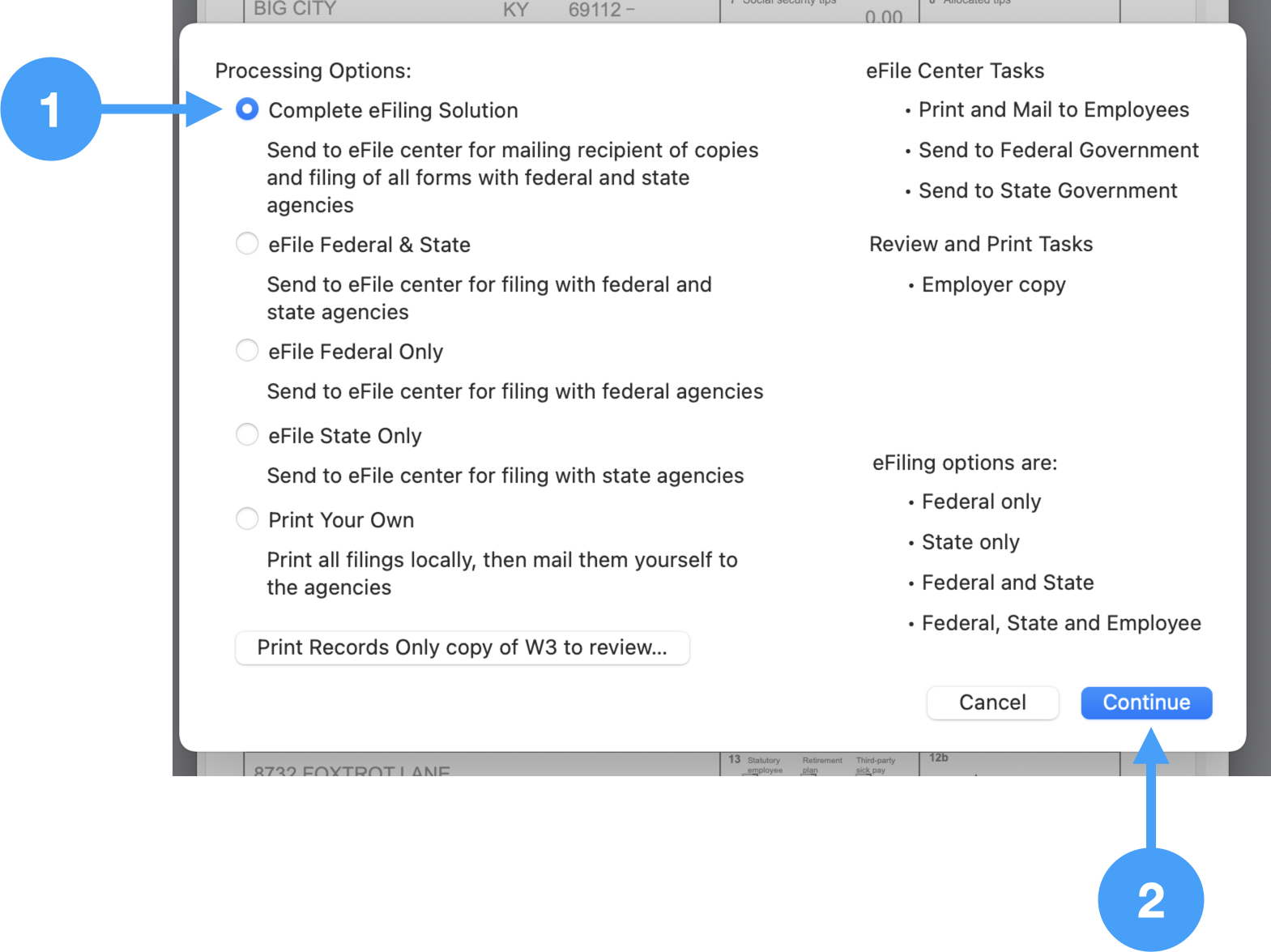

Processing Options

- In order to eFile your W-2/W-3's, select the first radio button under Processing Options, 'Complete eFiling Solution.'

- Click Continue to move to the next window.

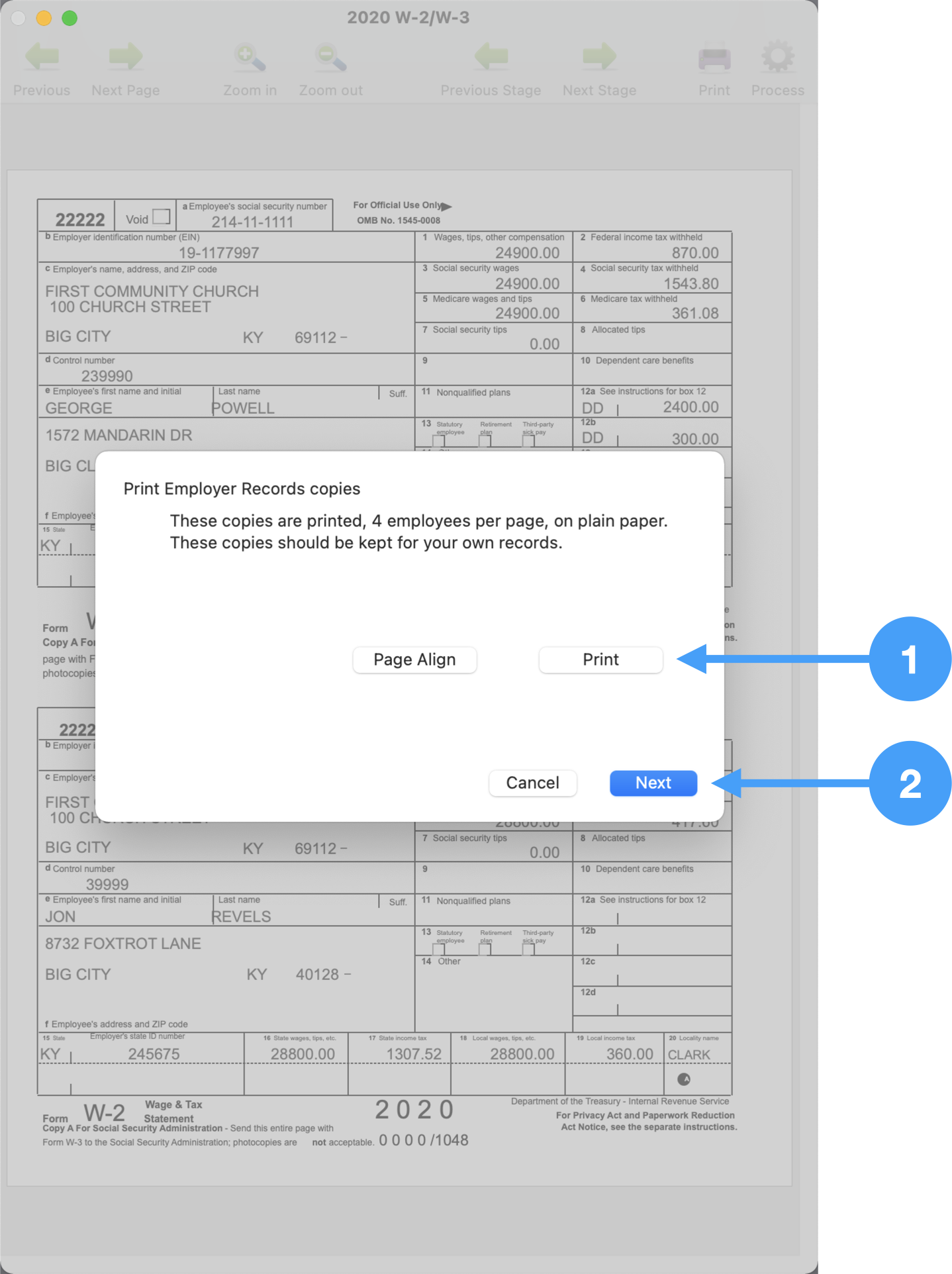

Printing of W-2 Forms

During the eFile process, the Employer Record form will be printed.

- Click Print

- Click Next to go to the step.

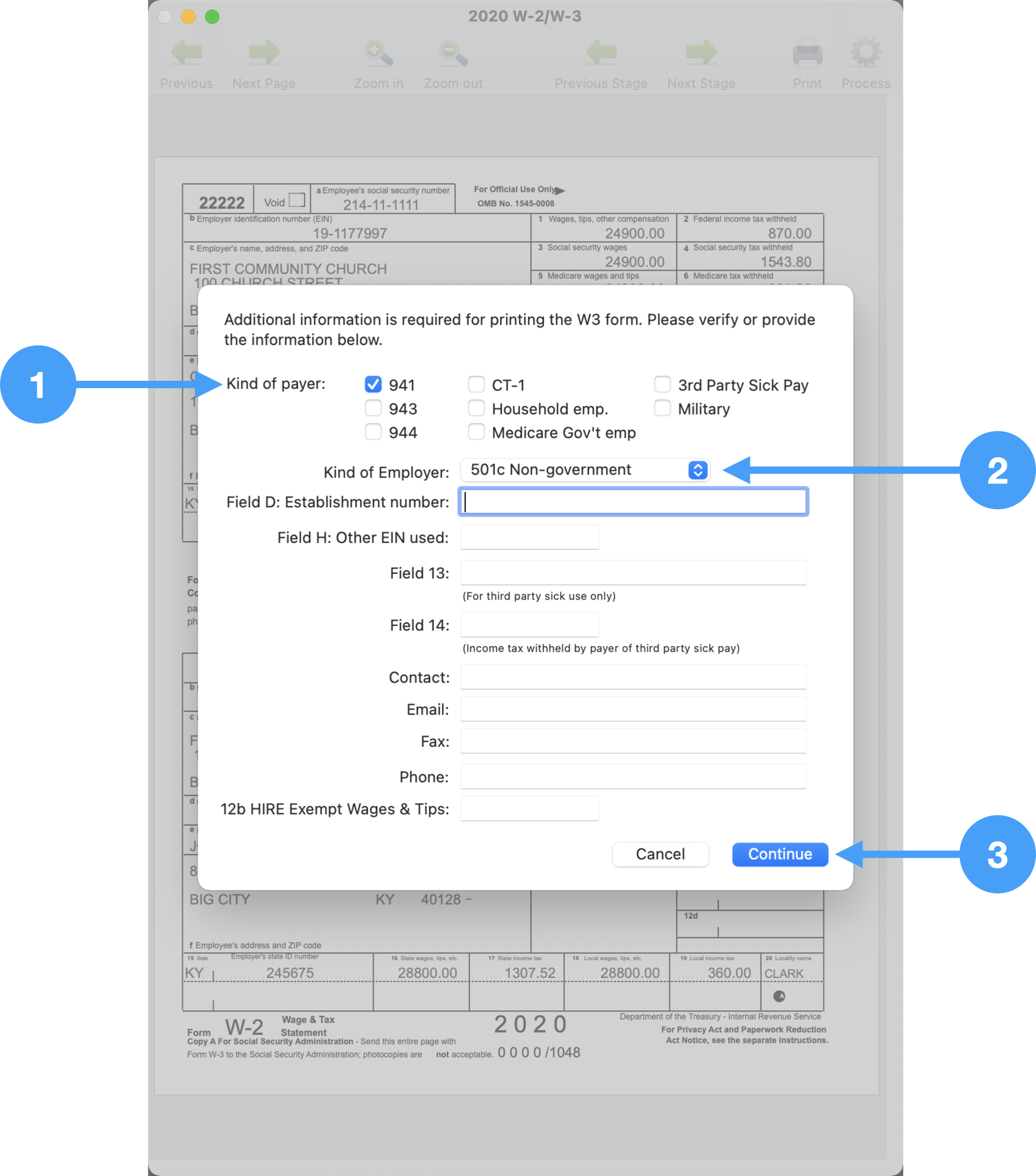

Setup Information for printing W-3 Form

- Select the Kind of Payer. In our case, it is 941 payer.

- Select the Kind of Employer. In this example, it is '501c Non-government.'

- Click Continue

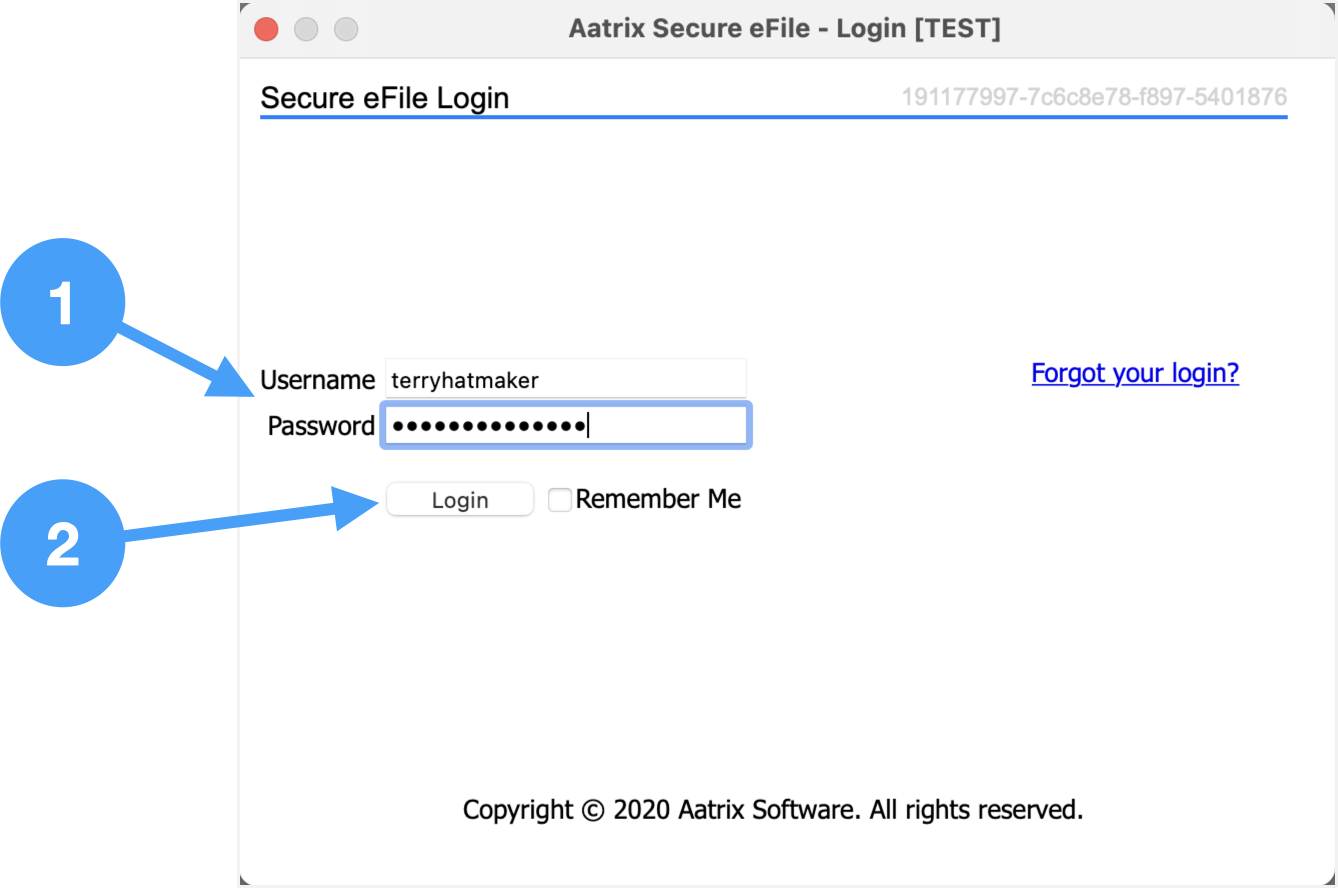

Sign into Aatrix eFile System

An Aatrix eFile account is needed for this step. An account can be created at the Aatrix eFile site.

- Enter Username and Password

- Click Login

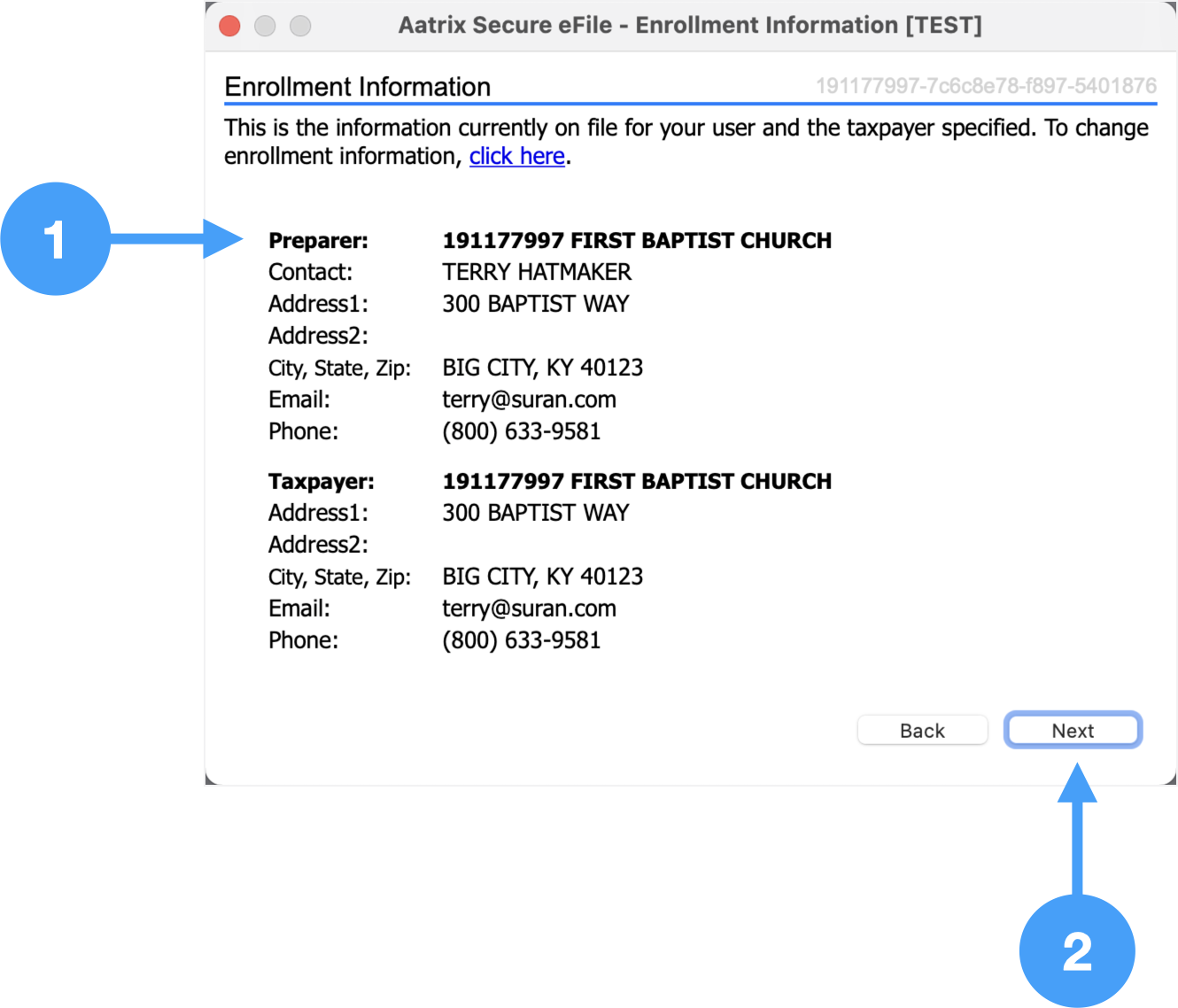

Review Enrollment Information

- Review the information on file and if any changes are needed, click on the link in the window.

- Click Next to move to the next window.

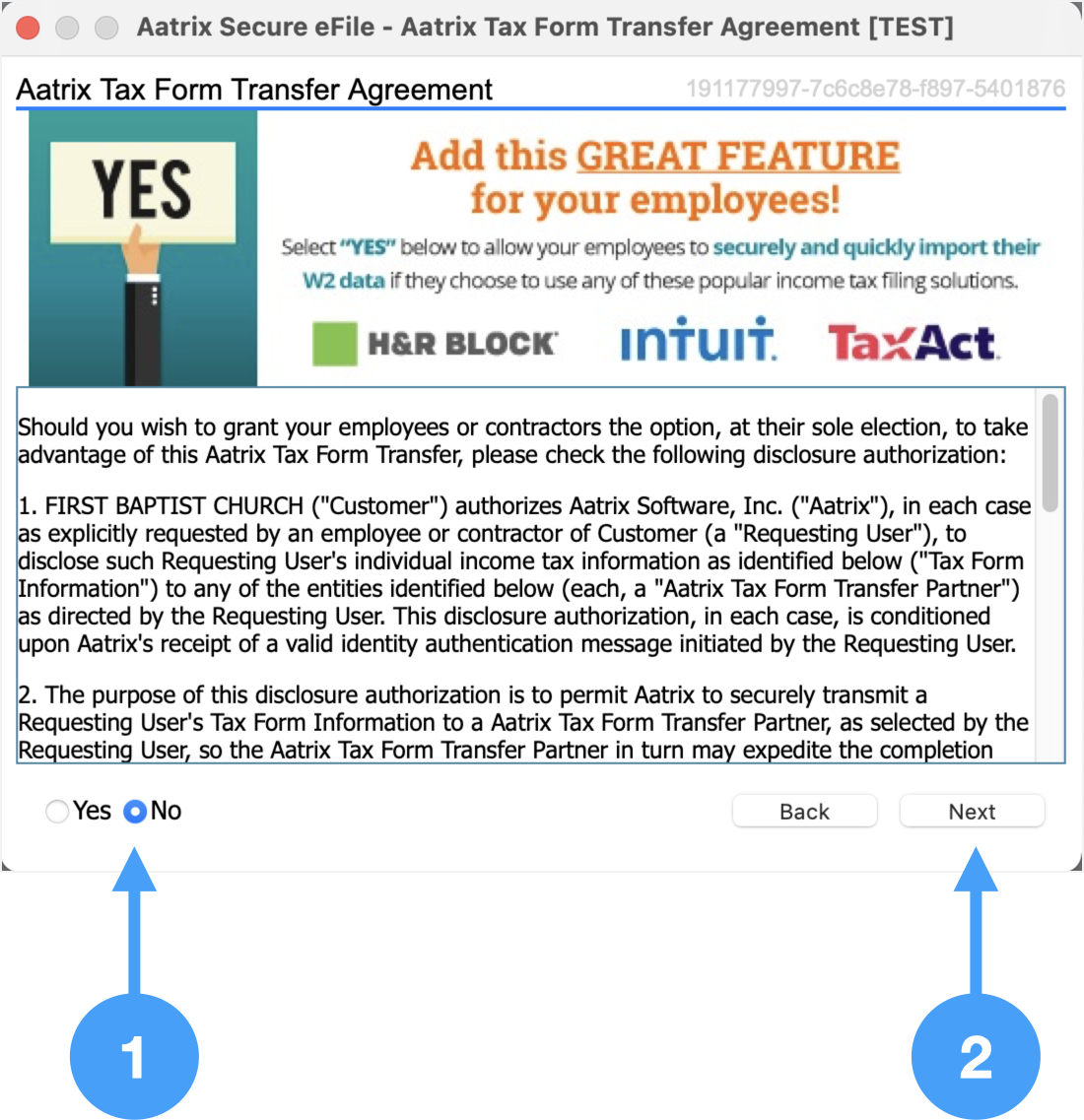

Aatrix Tax Form Transfer Agreement

- Read the information in this window and determine whether you wish for your employees to securely import their W-2 data into their income tax filing solution. In our example, we are selecting No.

- Click Next

Information about an Aatrix eFile Package

- Click No Thanks moving to the next step in the eFile process.

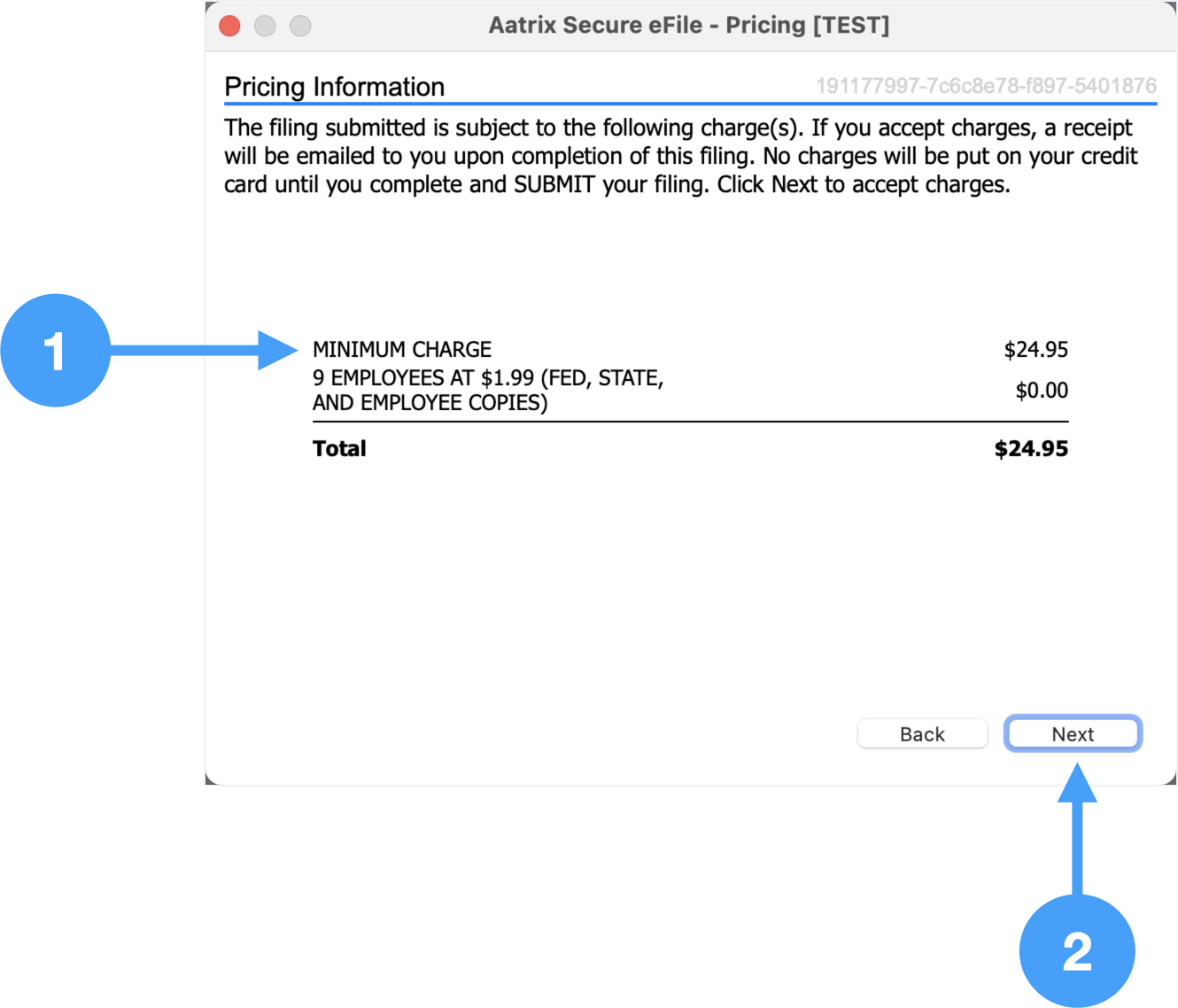

Pricing Information

- Review the pricing.

- Click Next to continue.

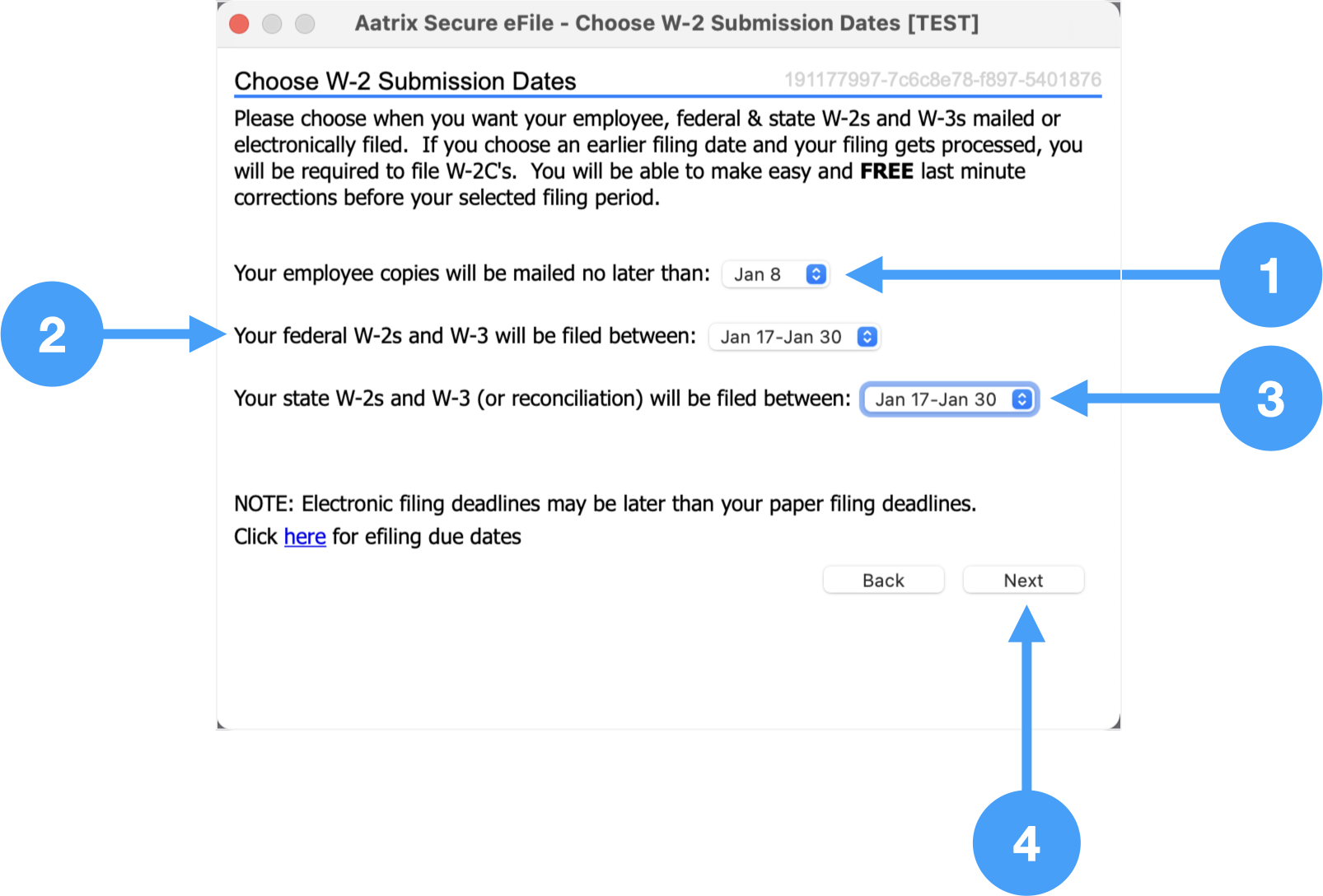

Choose W-2 Submission Dates

- Select the date for employee copies to be mailed.

- Select the date range you want your federal W-2's and W-3 to be filed.

- Select the date range you want your state W-2's and W-3 (or reconciliation) to be filed.

- Click Next to move to the next step.

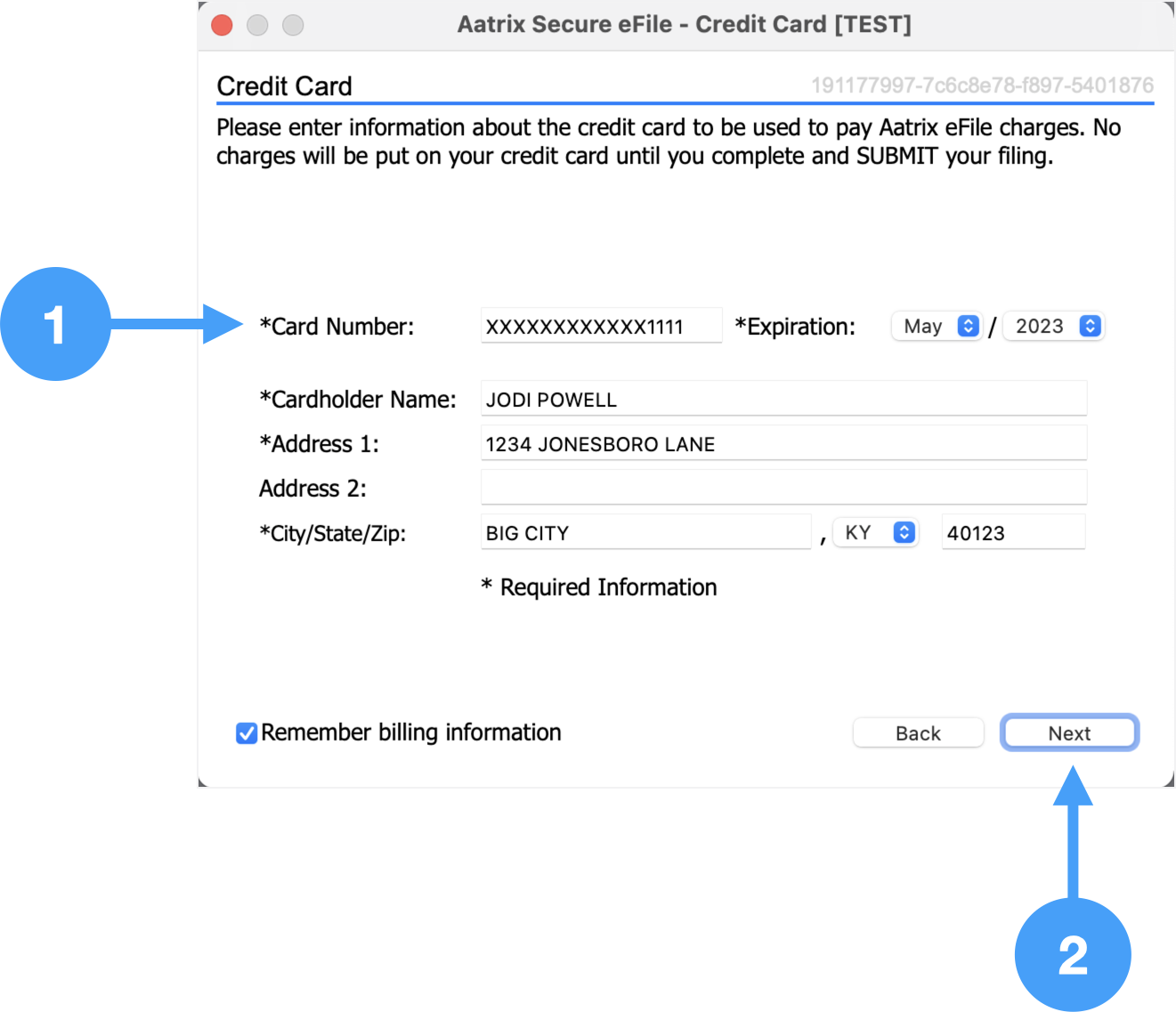

Enter Credit Card Information

- Enter all of the information for the required fields (fields with *).

- Click Next

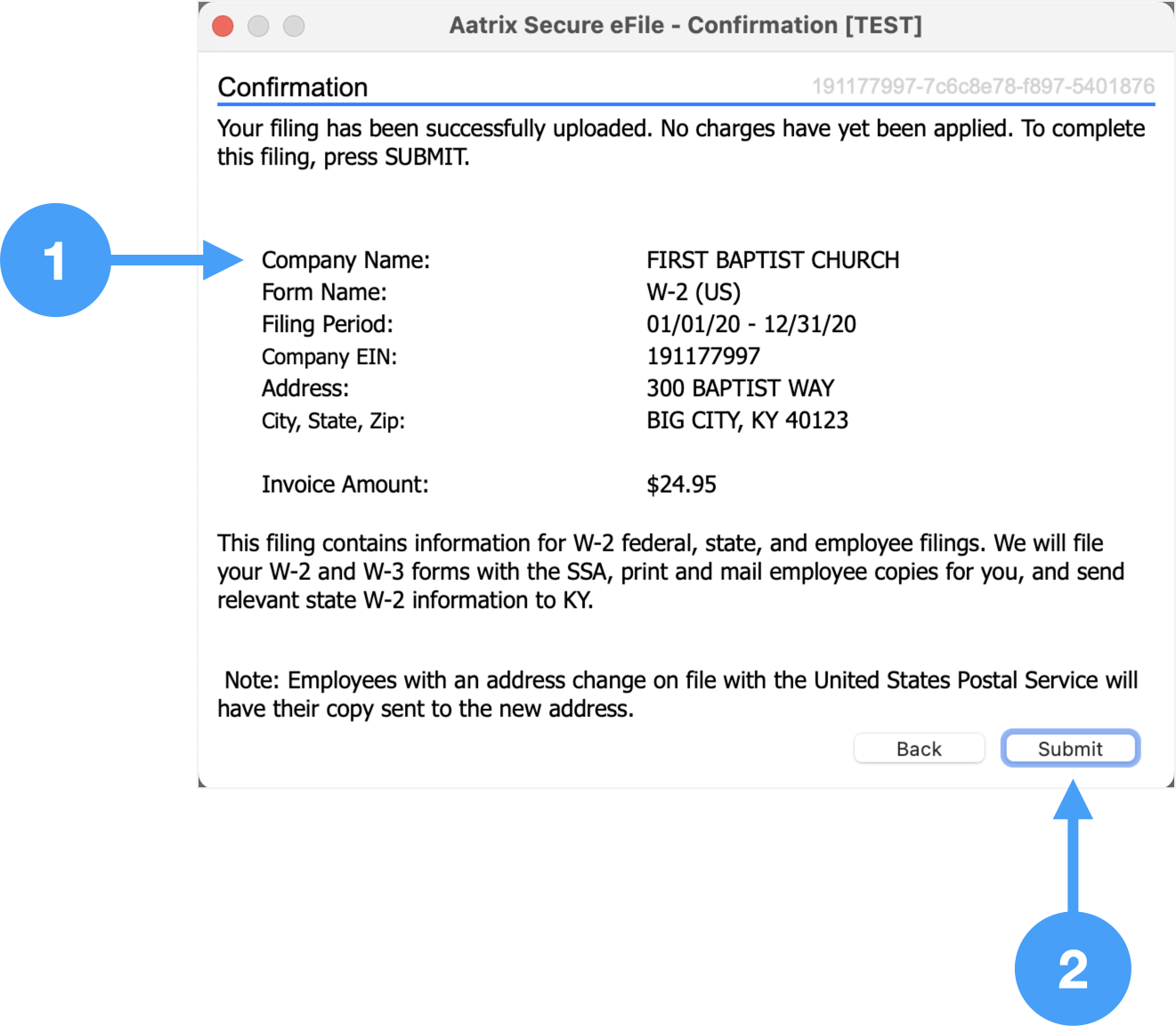

Confirmation

- Review information in this window.

- Click Submit to submit your W-2's and W-3 data.

Video of eFiling Process